Finance Documents

Tax Forms

2023 NJ-1080-C Instructions for Nonresident Individuals

This document provides detailed instructions for nonresident individuals applying for a composite return in New Jersey. It outlines eligibility requirements, filing deadlines, and payment options. Ensure compliance with New Jersey state tax regulations by following these guidelines.

Tax Forms

Form 8975 Schedule A for Multinational Reporting

Form 8975 Schedule A is used for reporting tax jurisdiction and constituent entity information for multinational enterprise groups. This document provides essential details required by the IRS for compliance. Accurate completion is vital to ensure proper tax reporting and adherence to regulations.

Savings Accounts

Health Savings Account Distribution Request Form

This Health Savings Account Distribution Request Form allows HSA accountholders to manage account distributions and closures. It provides necessary steps for completing the request and ensures compliance with tax requirements. Use this form to initiate a distribution or close your HSA responsibly.

Loans

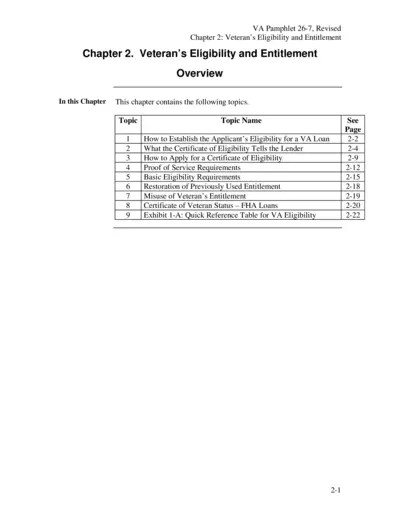

VA Pamphlet 26-7: Veteran's Eligibility and Entitlement

This file provides an overview of veteran eligibility and entitlement for VA loans. It includes essential instructions, application processes, and required documentation. Suitable for veterans seeking to understand their benefits and lenders needing to verify eligibility.

Tax Forms

Iowa W-4 Employee Withholding Allowance Certificate

The Iowa W-4 form is an essential document for employees in Iowa to manage their tax withholdings. It enables employees to claim allowances that determine the amount of state tax withheld from their paycheck. Proper filing of this form ensures accurate tax calculations and compliance with state regulations.

Banking

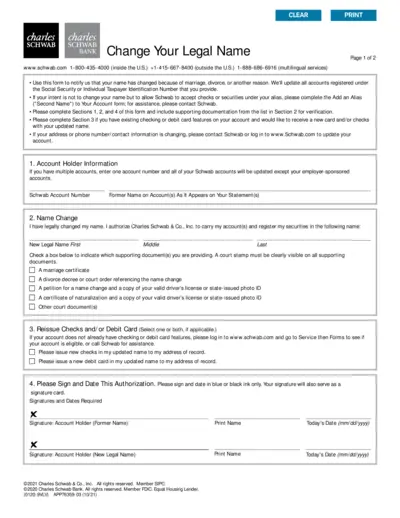

Change Your Legal Name Charles Schwab Bank

This document provides essential instructions for changing your legal name with Charles Schwab Bank. It includes information on required documentation and submission methods. Follow the guidelines to ensure your name is updated correctly across all accounts.

Tax Forms

Form 941c Instructions for Adjusting Tax Returns

Form 941c is used to correct information on previous tax returns for employers. This form is essential for filing adjustments related to income, social security, and Medicare taxes. Ensure accurate tax reporting and compliance by submitting this form with the relevant tax returns.

Banking

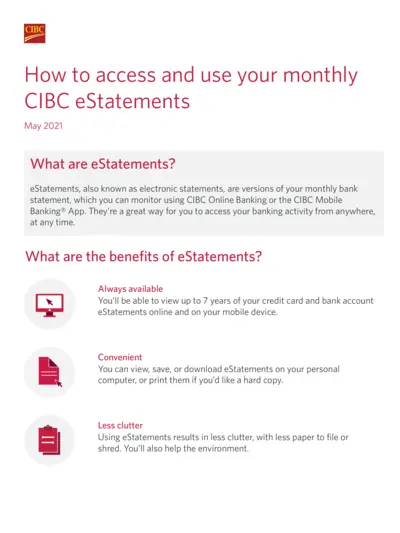

CIBC eStatements Access and Usage Instructions

This document provides detailed instructions on accessing your CIBC eStatements through Online Banking. Learn the benefits of eStatements and how to efficiently manage your banking information online. Ideal for clients looking to embrace digital banking solutions.

Tax Forms

Texas Franchise Tax Report Form 05-158-A

This file contains the Texas Franchise Tax Report Form 05-158-A for the reporting year 2014. It outlines the filing requirements and includes details on how to calculate the taxable margin. This document is essential for businesses filing taxes in Texas.

Banking

Ecobank Account Opening Application Guide

This document outlines the steps necessary to open an account with Ecobank. It includes detailed requirements for different types of accounts. Users can refer to this file for essential instructions and guidelines.

Tax Forms

South Carolina Individual Income Tax Payment Voucher

This file serves as the South Carolina Individual Income Tax Payment Voucher SC1040-V. It provides essential instructions for taxpayers filing their income tax payments. Users can learn how to complete and submit the voucher to the Department of Revenue.

Estate Planning

Understanding Dynasty Trusts for Estate Planning

This document provides an in-depth analysis of dynasty trusts, a valuable estate planning tool. It includes details on duration, structure, and tax benefits. Perfect for individuals looking to establish multi-generational wealth while minimizing tax obligations.