Finance Documents

Banking

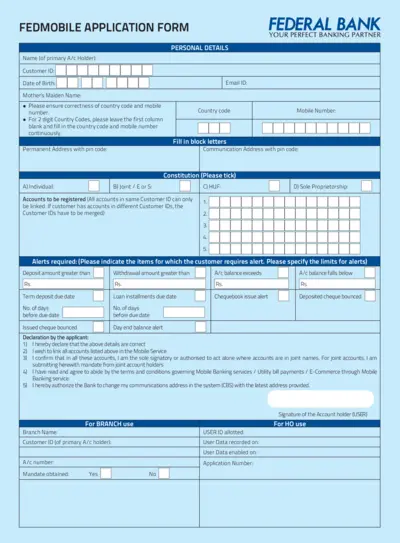

FedMobile Application Form - Federal Bank

The FedMobile Application Form is a key document for customers of the Federal Bank seeking mobile banking services. This form collects essential personal and account details to ensure secure access to mobile banking. Complete the form accurately to enjoy a seamless banking experience.

Tax Forms

Kansas City Profits Return Earnings Tax RD-108

The Form RD-108 is used by individuals and businesses to report and pay earnings tax in Kansas City, Missouri. It is essential for residents and non-residents with income from an unincorporated business. Accurate completion ensures compliance and helps avoid penalties.

Loans

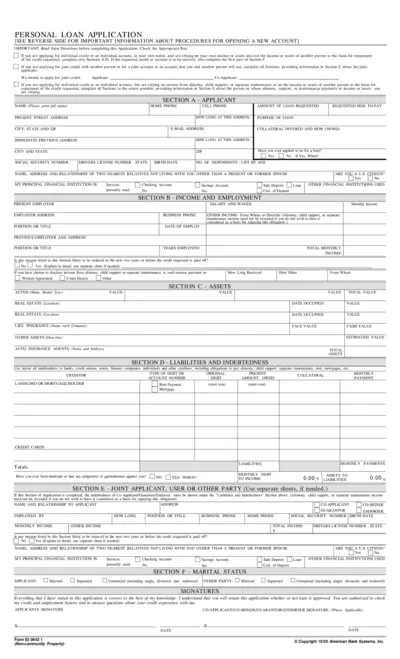

Personal Loan Application Form Instructions

This Personal Loan Application form allows individuals to apply for a loan by providing important financial and personal information. It includes sections for applicant details, income and assets, liabilities, and marital status. Fill it out accurately to facilitate the approval process.

Banking

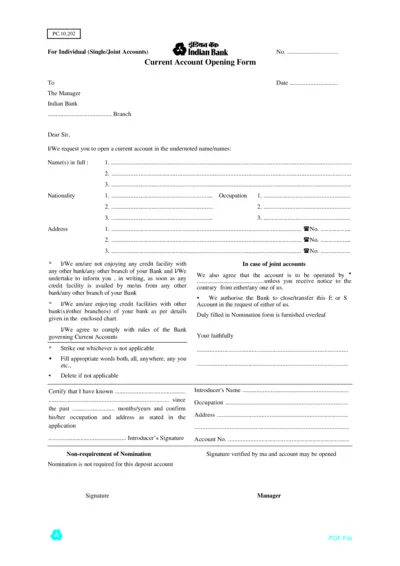

Indian Bank Current Account Opening Form

This file contains the Indian Bank current account opening form for individuals and joint accounts. It provides necessary details and instructions required for filling out the form. Users can navigate through various sections to complete their application efficiently.

Tax Forms

Instructions for Form 8978 Partner's Tax Reporting

This document provides detailed instructions for completing Form 8978, including Schedule A. It outlines the purpose, filing procedures, and requirements for partners reporting additional tax adjustments. This guide is essential for ensuring compliance with IRS regulations.

Tax Forms

California Form 3800 Tax Computation for Children

California Form 3800 is essential for calculating tax for children with unearned income. This form assists parents in reporting their child's income accurately. It ensures compliance with tax regulations for minors.

Tax Forms

Client Data Sheet for Tax Year Information

This Client Data Sheet is essential for gathering income and personal information for your tax return. Ensure you provide accurate data, including income forms and IDs for all individuals involved. This document serves as a comprehensive guide to assist in your tax preparation process.

Loans

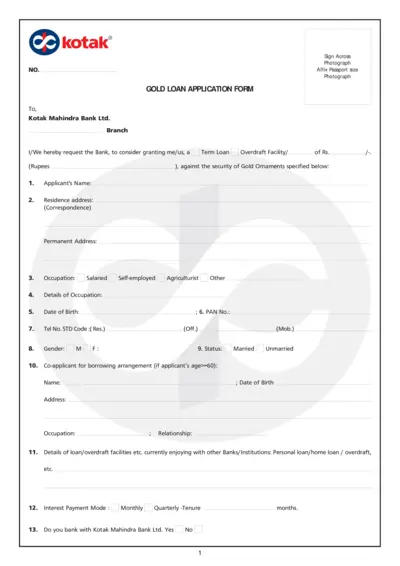

Kotak Gold Loan Application Form

This file is the Kotak Gold Loan Application Form containing essential details for borrowers seeking financial assistance against gold ornaments. It provides a comprehensive guide on how to fill out the application and the necessary information required. Perfect for individuals looking to secure a loan from Kotak Mahindra Bank.

Tax Forms

Flow-Through Entity Tax Return Form 5772 Instructions

This document provides detailed guidelines for completing the Flow-Through Entity Tax Return (Form 5772) for Michigan. It includes essential calculations, business income identification, and reporting instructions. Perfect for businesses and FTE stakeholders to accurately file their returns.

Tax Forms

Instructions for Form 2220 Underpayment Tax Filing

This document provides detailed instructions for corporations regarding underpayment of estimated taxes. It outlines who must file, how to file, and potential penalties for non-compliance. Essential for corporate tax planning and compliance.

Tax Forms

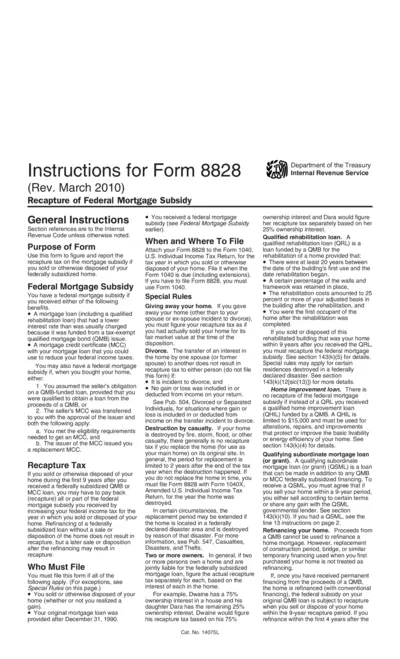

Instructions for Form 8828 Recapture of Mortgage Subsidy

Form 8828 provides taxpayers with guidelines on how to calculate and report recapture taxes associated with federally subsidized mortgages. This form is crucial for individuals who have disposed of their federally subsidized homes and need to understand their tax obligations. Familiarizing yourself with this form ensures compliance with IRS requirements when selling your home.

Tax Forms

Instructions for Form 8911 Alternative Fuel Credit

Form 8911 provides instructions for claiming the Alternative Fuel Vehicle Refueling Property Credit. This credit can help taxpayers reduce their tax liabilities related to alternative fuel refueling property. Ensure you're aware of eligibility for claiming this important credit.