Finance Documents

Retirement Plans

Citibank IRA Contribution Form Instructions

This document provides instructions for the Citibank IRA Contribution Form. Users can learn how to fill out the form correctly and submit it. It includes details about accounts and relevant notices.

Tax Forms

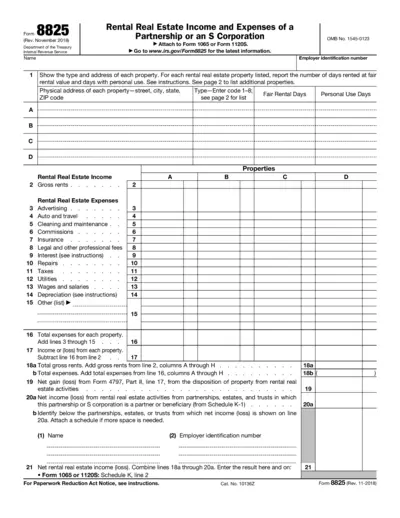

Form 8825 Rental Income and Expenses Worksheet

Form 8825 is used by partnerships and S corporations to report rental real estate income and expenses. It captures details about each property, including rental days and expenses to calculate net income or loss. This essential document is crucial for proper tax compliance in rental activities.

Retirement Plans

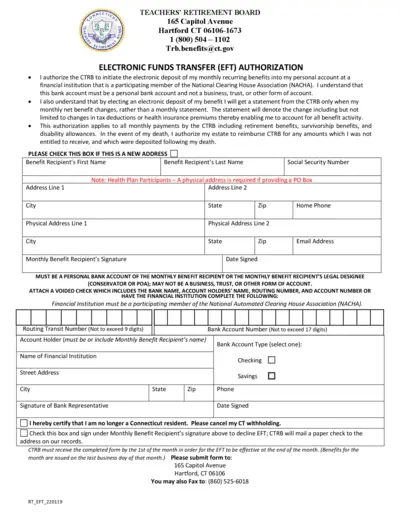

Connecticut Teachers' Retirement Board EFT Authorization

This file provides details about the Electronic Funds Transfer (EFT) authorization for monthly benefits. It includes instructions and information on how to fill out the form correctly. Essential for benefit recipients looking to set up electronic deposits.

Tax Forms

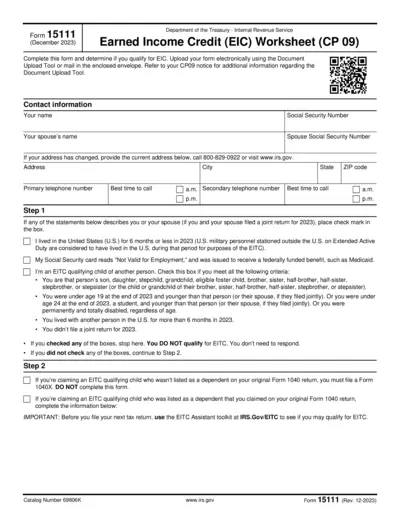

IRS Form 15111 Earned Income Credit (EIC) Worksheet

IRS Form 15111 helps individuals determine their eligibility for the Earned Income Credit (EIC). Complete this form to assess your qualification and submit it electronically or via mail. Be sure to refer to your CP09 notice for additional guidance on the EIC.

Tax Forms

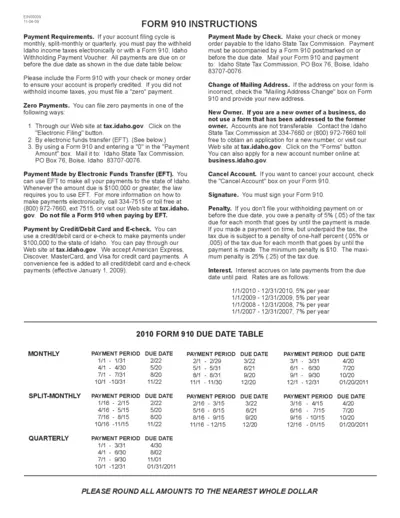

Idaho Form 910 Instructions for Withholding Payments

This document provides essential instructions for filing Idaho Form 910 for withholding payments. It covers payment requirements, filing schedules, and procedures for various types of filers. Ideal for business owners and payroll personnel managing Idaho income tax withholdings.

Tax Forms

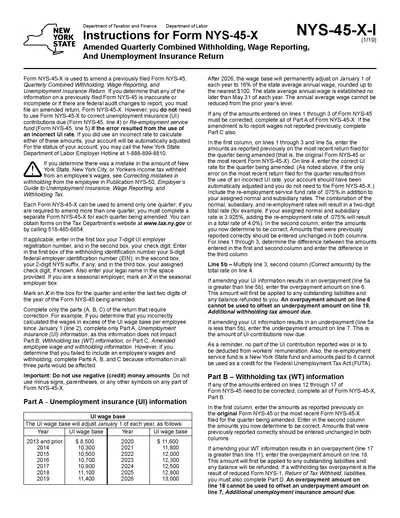

Instructions for Form NYS-45-X - Amended Return

Form NYS-45-X provides instructions for amending quarterly withholding tax and unemployment insurance returns in New York. This form is essential for employers who need to correct previously submitted information. Understanding how to properly fill out this form can help avoid errors and potential penalties.

Tax Forms

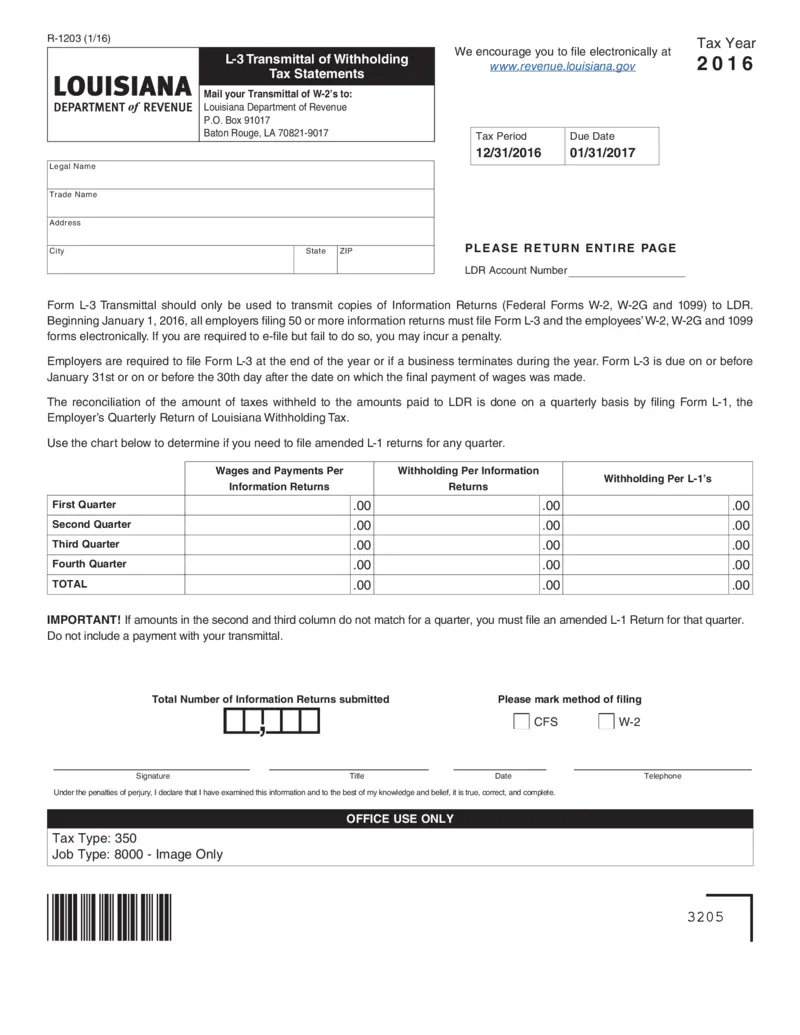

L-3 Transmittal of Withholding Tax Statements

The L-3 form is essential for Louisiana employers who need to transmit W-2 and 1099 forms to the Department of Revenue. Filing electronically is mandatory for those reporting 50 or more information returns. Ensure timely submission to avoid penalties and maintain compliance.

Banking

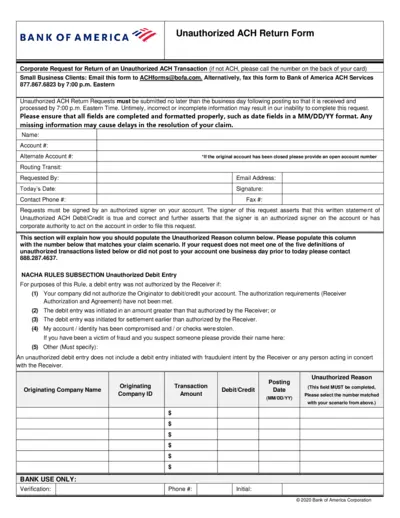

Bank of America Unauthorized ACH Return Form

This form allows small business clients to request the return of an unauthorized ACH transaction. It provides detailed instructions for completing the request efficiently. Ensure timely submission to avoid delays in processing.

Banking

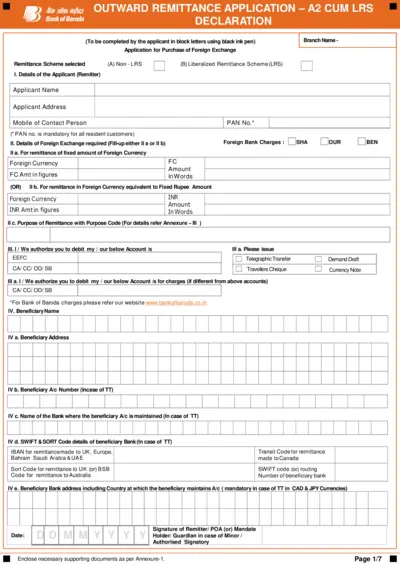

Bank of Baroda Outward Remittance Application Form

This application form is used for outward remittances through Bank of Baroda. It provides necessary details required for purchasing foreign exchange under the Liberalized Remittance Scheme. Ensure all sections are filled accurately to avoid delays.

Loans

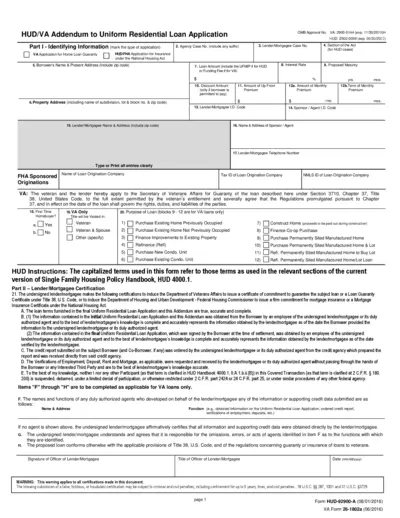

HUD VA Addendum to Uniform Residential Loan Application

This file contains the HUD/VA Addendum for a Uniform Residential Loan Application. It provides essential details and certifications required for mortgage applications. Users can refer to it for guidance on filling out loan applications for VA and FHA loans.

Tax Forms

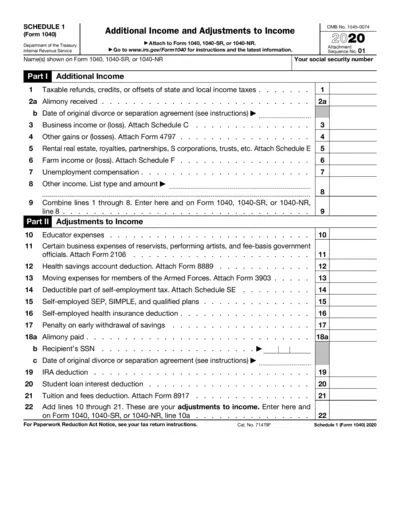

Schedule 1 Form 1040 Additional Income Instructions

This file provides essential instructions and information for filling out Schedule 1 of Form 1040. It is crucial for taxpayers to report additional income and adjustments. Completing this form accurately helps ensure proper tax compliance.

Loans

Norka Loan Application Form Instructions

This document provides detailed information about the Norka loan application process. It includes eligibility criteria and application forms for Norka loans. Get essential guidance to navigate through the application easily.