Finance Documents

Tax Forms

Form 990-W: Estimated Tax Worksheet for Organizations

Form 990-W is designed for tax-exempt organizations to calculate estimated tax on unrelated business taxable income. This form assists private foundations in determining their investment income tax obligations. Users can access essential instructions and guidelines tailored for efficient completion.

Loans

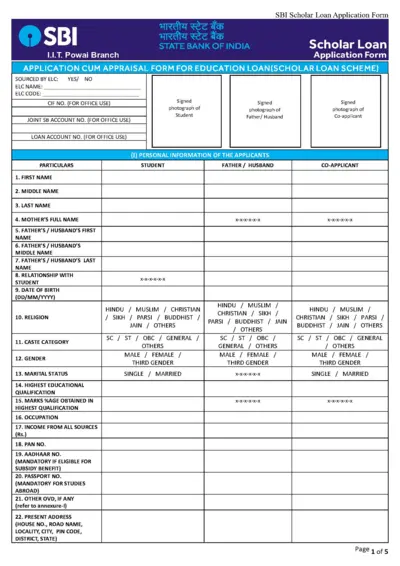

SBI Scholar Loan Application Form - Complete Guide

The SBI Scholar Loan Application Form is a comprehensive document required for securing education loans at the State Bank of India. It contains personal, financial, and educational details needed for loan processing. Ensure to fill it correctly to avoid delays in your application.

Banking

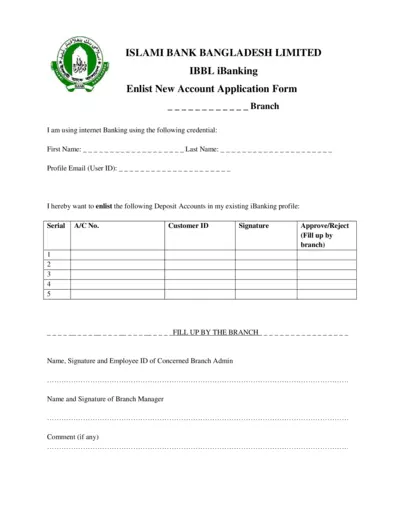

iBanking New Account Application Form - IBBL

This file is the New Account Application form for iBanking with Islami Bank Bangladesh Limited. It contains essential details required to enlist new deposit accounts. Complete this form accurately to access online banking services.

Tax Forms

New York State Tax Credits Form IT-203 Instructions

This document contains essential instructions for filling out Form IT-203, which is used to report various tax credits and taxes in New York State. It provides detailed sections on different types of credits and taxes applicable to residents. Follow the guidelines to ensure compliance and maximize your eligible credits.

Tax Forms

Personal Tax Credits Forms TD1 TD1ON Overview

This file provides essential information about Personal Tax Credits Forms TD1 and TD1ON. Learn how to fill out these forms to manage your tax deductions effectively. Discover eligible exemptions and requirements for accurate tax calculations.

Tax Forms

PA-41 Schedule B Instructions for 2023

The PA-41 Schedule B form is essential for estates and trusts to report dividend and capital gains distributions income. It provides clear instructions for accurate completion. Understanding how to fill out this form ensures compliance with Pennsylvania tax regulations.

Banking

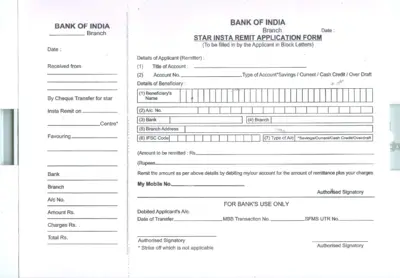

Star Insta Remit Application Form

The Star Insta Remit Application Form facilitates fund transfers through Bank of India. This form must be filled out completely by the applicant for processing. Please ensure all information is accurate to avoid delays in transactions.

Tax Forms

Virginia Pass-Through Entity Return Instructions

This document provides the step-by-step instructions for filling out the Virginia Form 502, Pass-Through Entity Return. It includes important updates, filing guidelines, and relevant tax credits for the 2015 tax year.

Banking

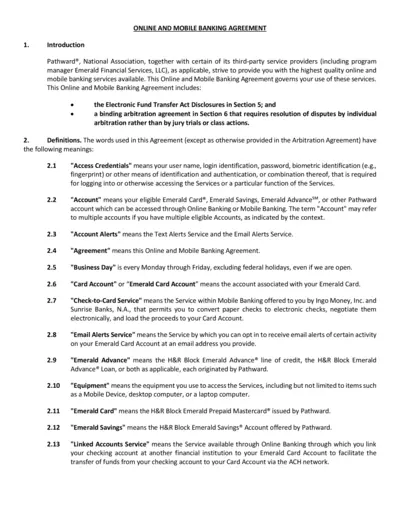

Online and Mobile Banking Agreement by Pathward

This document outlines the terms and conditions for using online and mobile banking services. It's essential for users of Pathward's banking services. It includes vital information on account access and security.

Retirement Plans

NYCE IRA for NYC Employees Retirement Savings

This document provides essential information about the NYCE IRA offered to New York City employees. It includes instructions for funding and managing your IRA, as well as details for spousal accounts. Learn how to take advantage of this important retirement savings opportunity.

Tax Forms

Form 8949 Instructions for Capital Asset Transactions

This file contains essential instructions for filling out IRS Form 8949, which is used for sales and other dispositions of capital assets. It provides detailed guidance on reporting capital gains or losses accurately. Perfect for taxpayers needing to manage their capital asset transactions effectively.

Tax Forms

Waller County Appraisal District Homestead Exemption

This application allows property owners to claim residence homestead exemptions for tax benefits. It includes sections for personal information, property details, and exemption categories. Completing this form helps you secure potential property tax savings.