Finance Documents

Tax Forms

Form 8082 Notice of Inconsistent Treatment

Form 8082 is used to report inconsistent treatment of tax items. It provides an Administrative Adjustment Request (AAR) for partners and shareholders regarding tax liabilities. This form ensures compliance with IRS regulations and aids in proper tax reporting.

Tax Forms

FTB 3586 Payment Voucher for e-filed Corporation Returns

The FTB 3586 is a payment voucher for corporations that file their tax returns electronically. It is essential for those with a balance due to submit their payments accurately. Proper use of this form ensures compliance with California tax regulations.

Banking

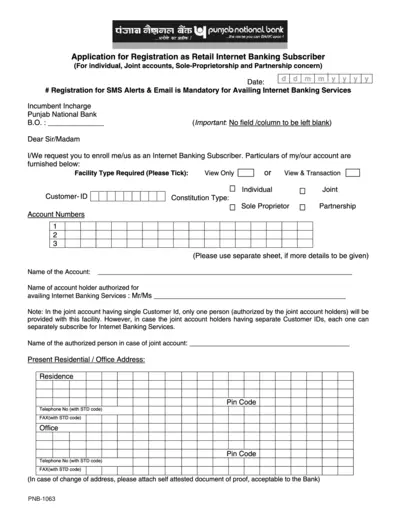

Punjab National Bank Internet Banking Registration Form

This document provides the necessary application for enrolling as a Retail Internet Banking subscriber at Punjab National Bank. A detailed guide is included to assist customers in filling out the form accurately. Essential information related to internet banking services is mandatory for all applicants.

Tax Forms

Self-Employment Tax Schedule SE Form 1040 Instructions

This form is essential for self-employed individuals to calculate and report their self-employment tax obligations. It provides the necessary details on net earnings and tax owed based on self-employment income. Completing this form accurately is required to ensure compliance with IRS regulations.

Banking

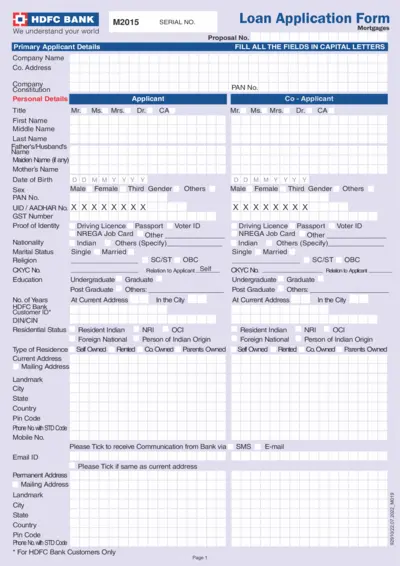

HDFC Bank Loan Application Form Instructions

This file provides comprehensive details for applying for a loan from HDFC Bank. It contains personal, financial, and property information requirements. Follow the instructions for a successful application process.

Tax Forms

NC-40 PTE Estimated Income Tax Instructions

This file provides detailed instructions for completing the NC-40 PTE form for estimated income tax payments for taxed partnerships in North Carolina. It outlines who must file and important deadlines. Ensure compliance with the instructions to avoid penalties.

Banking

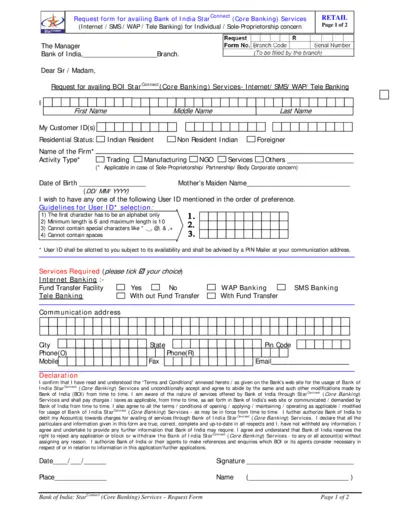

Bank of India StarConnect Request Form

This form is essential for individuals and sole proprietorships seeking to avail Bank of India StarConnect services. It facilitates requests for internet, SMS, WAP, and tele banking services. Ensure all fields are filled accurately to avoid processing delays.

Tax Forms

Illinois RUT-25-LSE Use Tax Return for Lease

The RUT-25-LSE form is required for reporting use tax for leased vehicles in Illinois. It is essential for lessors and lessees engaging in leases from out-of-State retailers. Proper completion is necessary for compliance with Illinois tax laws.

Tax Forms

NYC MTA Surcharge Return Form CT-3-M Instructions

This file contains detailed instructions for completing Form CT-3-M, the MTA Surcharge Return for corporations in New York State. It outlines filing requirements, deadlines, and notable updates for 2023. Businesses operating within the Metropolitan Commuter Transportation District must complete this form accurately to comply with state laws.

Tax Forms

Instructions for Form 1139 Corporation Refund

This document provides detailed instructions for completing Form 1139, used by corporations to apply for a tentative refund. It outlines the necessary information, eligibility requirements, and specific guidelines for various tax scenarios. Understanding these instructions ensures that corporations can accurately file for tax refunds related to net operating losses and other credits.

Banking

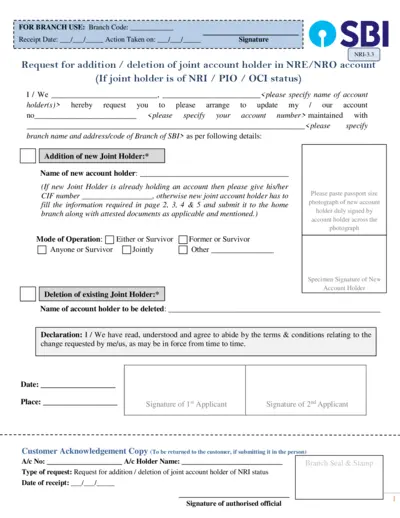

Request for Joint Account Holder Addition/Deletion

This file facilitates the request for adding or removing joint account holders in NRE/NRO accounts at SBI. It includes essential personal details and identification requirements. Ensure all documents are attested and submitted to the home branch.

Loans

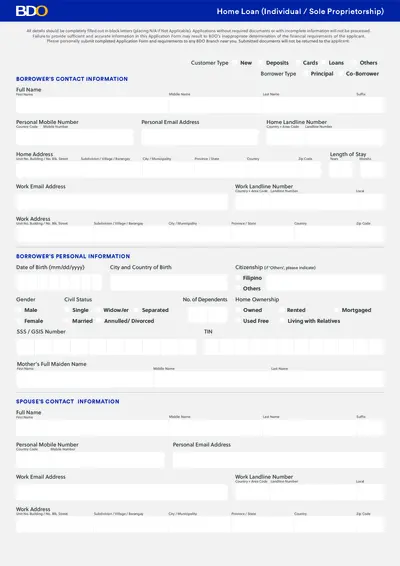

BDO Home Loan Application Guidelines and Instructions

This file contains comprehensive details about the BDO Home Loan application process, including required information and necessary documents. Applicants must ensure all sections are filled out correctly to avoid delays in processing. Follow the outlined instructions for a smooth application experience.