Personal Finance Documents

Banking

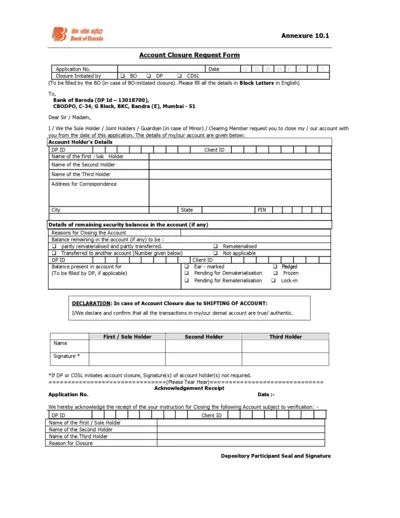

Bank of Baroda Account Closure Request Form

This file contains the application form for closing an account with Bank of Baroda. It provides details on the required information and submission process. Users can follow the instructions for filling out the form correctly.

Tax Forms

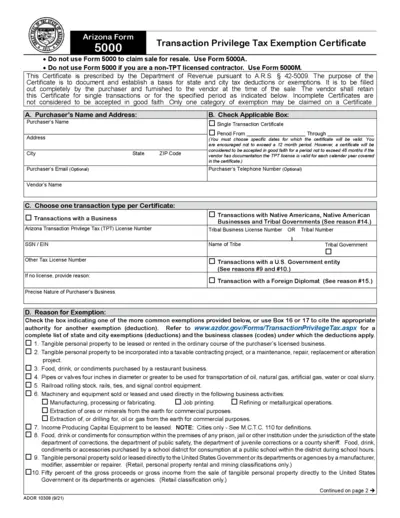

Arizona Transaction Privilege Tax Exemption Certificate

This document serves as the Transaction Privilege Tax Exemption Certificate for Arizona. It helps businesses and individuals document and establish tax deductions or exemptions. Complete this form accurately to comply with state tax laws.

Banking

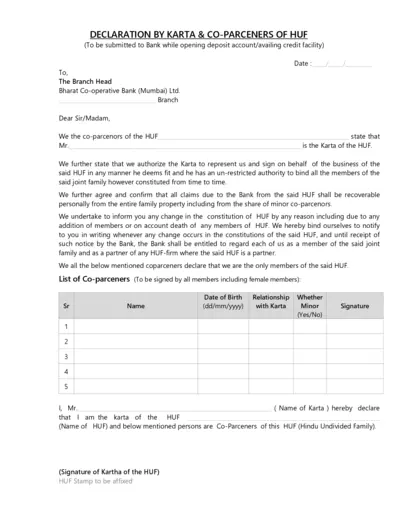

Declaration by Karta Co-Parceners of HUF for Bank

This document is needed for co-parceners of a Hindu Undivided Family (HUF) to authorize the Karta to operate a bank account. It outlines the roles and responsibilities of the Karta and the members. Proper completion ensures compliance with bank requirements.

Tax Forms

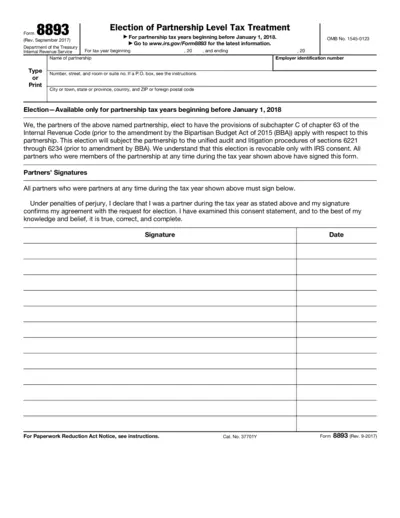

Form 8893 Election of Partnership Level Tax Treatment

Form 8893 allows partnerships to elect provisions under the Internal Revenue Code prior to 2018. This election enables unified audit and litigation procedures. It’s primarily for small partnerships with 10 or fewer individual partners.

Tax Forms

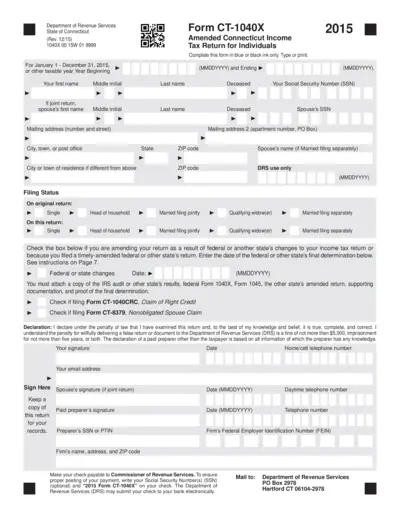

Form CT-1040X Amended Connecticut Income Tax Return

Form CT-1040X is used for filing an amended income tax return for individuals in Connecticut. It lets taxpayers correct previous tax returns for the year 2015. Ensure to follow the instructions carefully to complete the form accurately.

Tax Forms

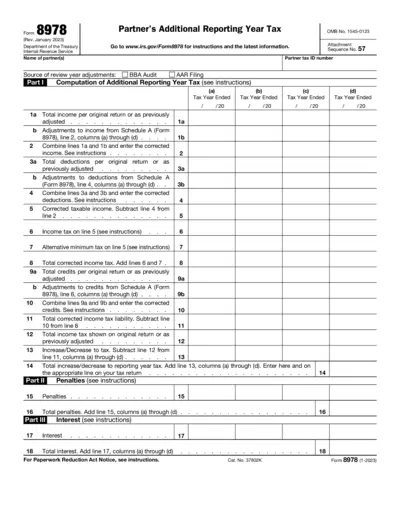

Form 8978 Additional Reporting Year Tax Instructions

Form 8978 provides detailed instructions for partners regarding Additional Reporting Year Tax. It outlines the necessary steps for computation and submission. This form is essential for ensuring accurate reporting during tax assessments.

Estate Planning

Revocable Living Trust Amendment Form Instructions

This file provides detailed instructions on how to complete a Revocable Living Trust Amendment Form. It is essential for individuals looking to amend beneficiary designations or other specific terms within their trust. Proper completion ensures compliance with relevant state laws.

Tax Forms

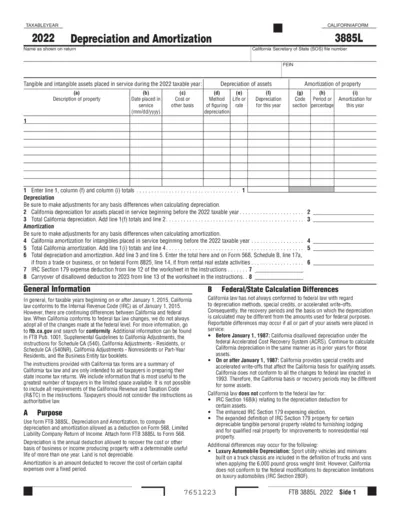

California Form 3885L - Depreciation and Amortization

California Form 3885L is used for computing depreciation and amortization deductions for the 2022 taxable year. This form assists businesses in calculating allowable deductions for tangible and intangible assets. It provides guidance on how to report these deductions accurately on the tax return.

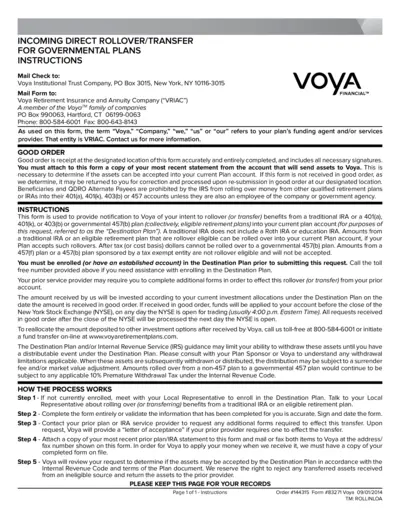

Retirement Plans

Incoming Direct Rollover Transfer Instructions

This file provides detailed instructions for rolling over or transferring benefits into your current plan account. It includes important contact information and guidance on completing necessary forms. Ideal for those looking to navigate governmental retirement plans.

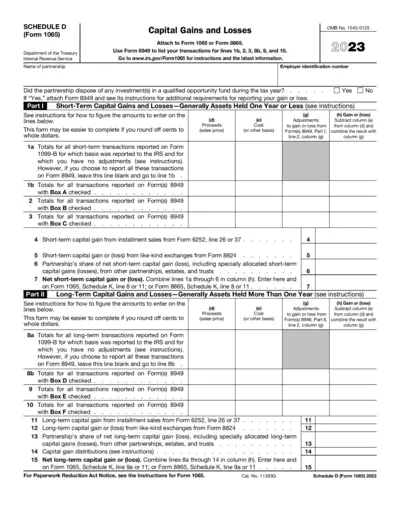

Tax Forms

Schedule D Form 1065 Capital Gains Losses Instructions

Schedule D (Form 1065) provides essential information for partnerships to report capital gains and losses. This form is crucial for accurately reporting transactions and tax obligations. Use this guide to navigate the filling of this important IRS document.

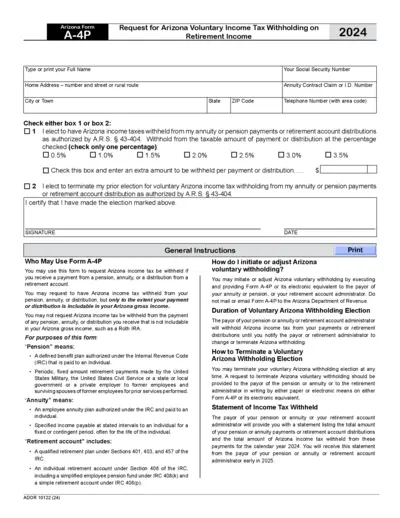

Tax Forms

Arizona Form A-4P Voluntary Income Tax Withholding

This form is used to request Arizona income tax withholding on retirement income. It allows individuals to elect withholding from annuity or pension payments. The form details the necessary information and instructions for making this request.

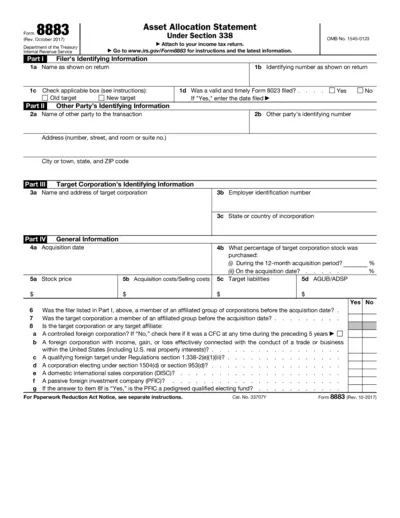

Tax Forms

Form 8883 Asset Allocation Statement for IRS Tax Filing

Form 8883 is the Asset Allocation Statement required by the IRS for reporting asset transfers in transactions under Section 338. It helps users accurately allocate the selling price and assess tax implications. Properly filling out this form ensures compliance with IRS regulations.