Personal Finance Documents

Tax Forms

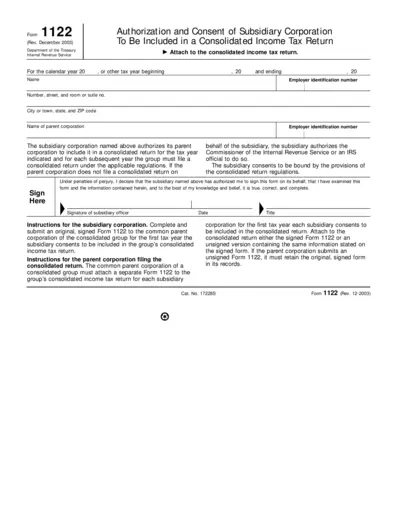

Form 1122 Authorization for Consolidated Tax Return

Form 1122 is a crucial IRS form allowing a subsidiary corporation to be included in a parent corporation's consolidated income tax return. This authorization simplifies the tax filing process for corporate entities. Proper submission ensures compliance with IRS regulations and avoids potential penalties.

Tax Forms

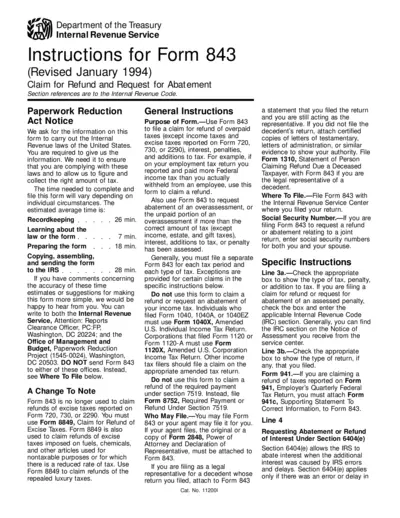

Instructions for Form 843 Claim for Refund

Form 843 provides instructions for claiming a refund or requesting an abatement for overpaid taxes and penalties. It is essential for those who need to correct their tax payments. Ensure to read the instructions thoroughly for accurate filing.

Tax Forms

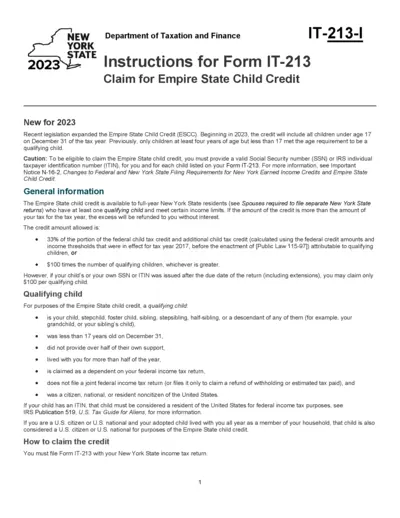

Instructions for Form IT-213 Claim for Empire State Child Credit

This file contains important instructions for completing Form IT-213 to claim the Empire State Child Credit. It outlines eligibility requirements, how to calculate the credit, and specific line-by-line instructions. This information is crucial for New York residents seeking to benefit from this tax credit in 2023.

Tax Forms

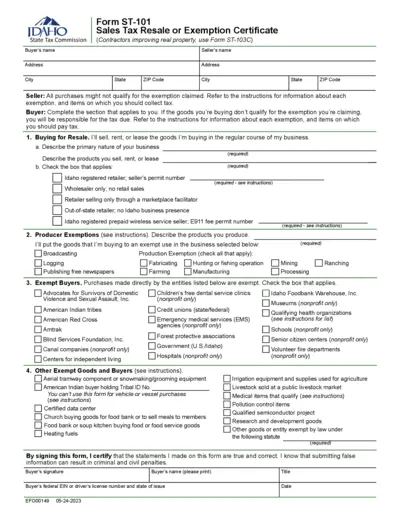

Idaho Sales Tax Resale or Exemption Certificate

This document serves as the Sales Tax Resale or Exemption Certificate for the State of Idaho. Businesses and organizations can use this certificate to claim tax exemptions on eligible purchases. Properly completed, this form helps buyers avoid unnecessary tax payments.

Banking

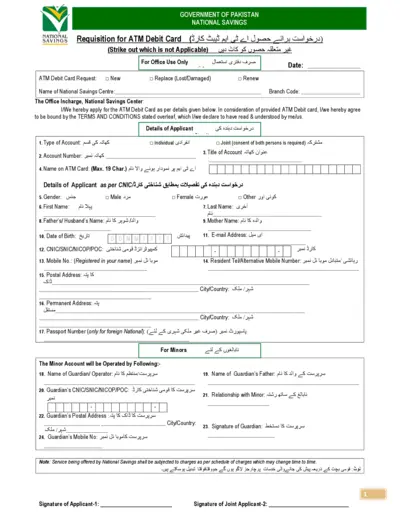

ATM Debit Card Application Form - National Savings

This file provides the requisition form for applying for an ATM debit card through the National Savings Centre. Users must fill out the form accurately to gain access to ATM services. Ensure all details are complete to expedite the processing of your request.

Banking

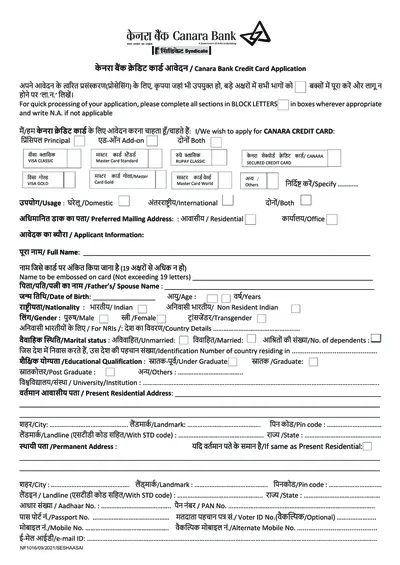

Canara Bank Credit Card Application Form

This form is for applying for a credit card with Canara Bank. It requires essential personal and financial information for processing your application. Please ensure to fill it out accurately for swift processing.

Tax Forms

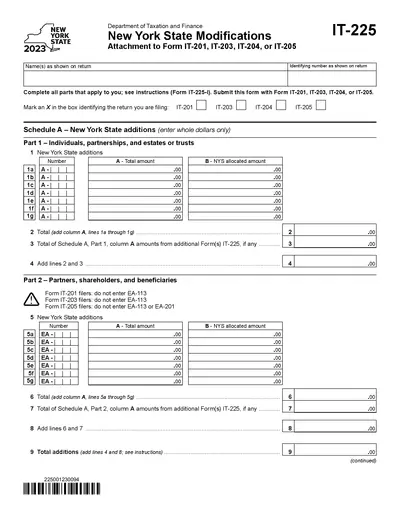

New York State Tax Modifications Form IT-225 2023

The New York State Modifications form IT-225 is essential for filing your tax return accurately. It includes necessary adjustments to ensure proper calculations. Use this form to report additions and subtractions relevant to your tax filings.

Tax Forms

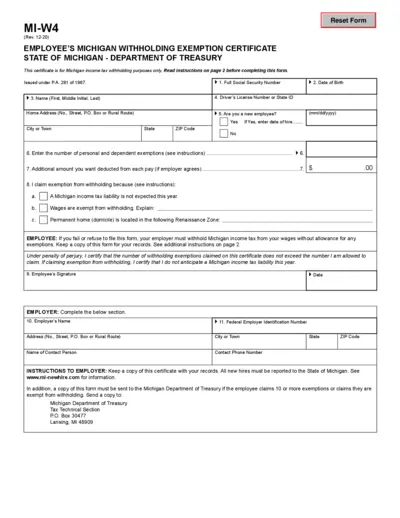

Michigan Withholding Exemption Certificate Form MI-W4

This form is essential for Michigan employees to declare their withholding exemptions. It ensures the correct amount of state income tax is withheld from paychecks. Properly filling out the MI-W4 can prevent over-withholding and ensure compliance with state regulations.

Loans

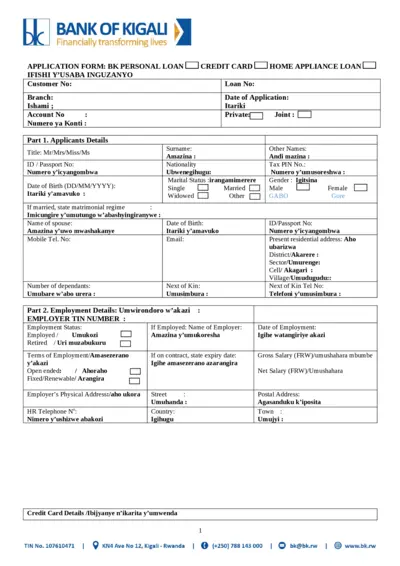

BK Personal Loan Application Form - Bank of Kigali

This document is the application form for the Bank of Kigali personal loan. It guides users through the information required for submitting a loan request. Filling out this form accurately is crucial for the loan approval process.

Tax Forms

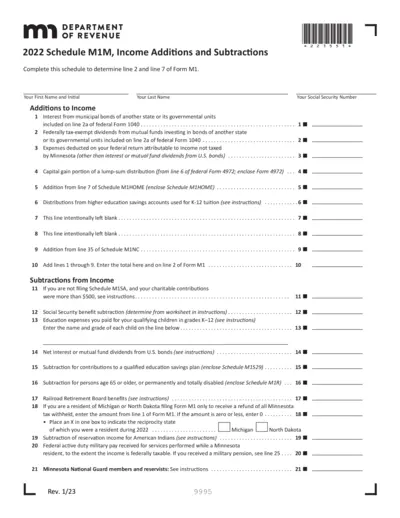

2022 Schedule M1M Income Additions and Subtractions

The 2022 Schedule M1M is a tax form used to report income additions and subtractions for Minnesota residents. This form is essential for accurately calculating your Minnesota taxable income. Follow the provided guidelines to ensure correct reporting.

Tax Forms

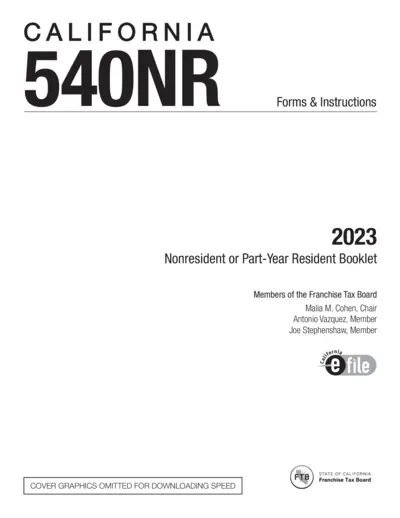

California 540NR Nonresident Tax Filing Instructions 2023

The California 540NR booklet provides essential instructions for nonresidents or part-year residents to file their state income tax. It includes important dates, forms, credits, and common errors to avoid. This guide is crucial for understanding the filing process and ensuring compliance with California tax regulations.

Tax Forms

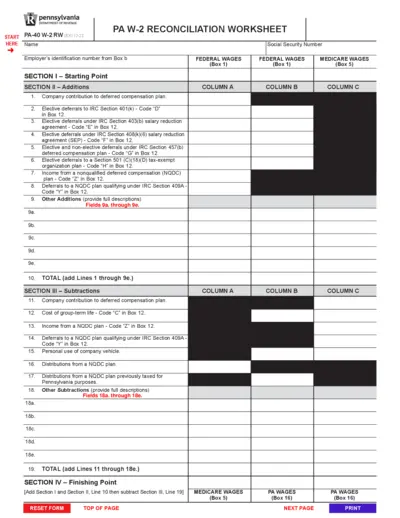

PA W-2 Reconciliation Worksheet Instructions

The PA W-2 Reconciliation Worksheet is essential for reconciling Pennsylvania income tax purposes. It assists taxpayers in detailing information from federal Form W-2. Use this form for reporting income accurately and ensuring compliance with tax regulations.