Personal Finance Documents

Tax Forms

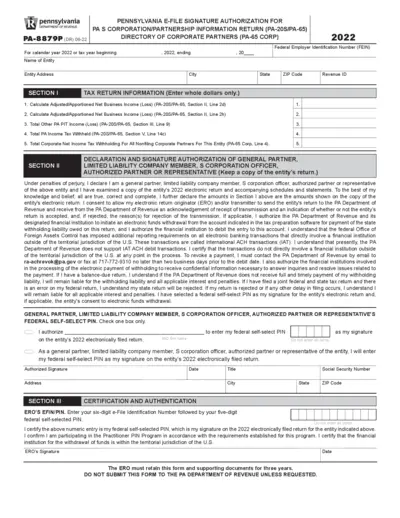

Pennsylvania E-File Signature Authorization Form

The PA-8879P allows general partners, LLC members, and S corporation officers to electronically sign tax returns. Proper completion is essential for a smooth filing process. Utilize this form to ensure compliance with Pennsylvania tax regulations.

Banking

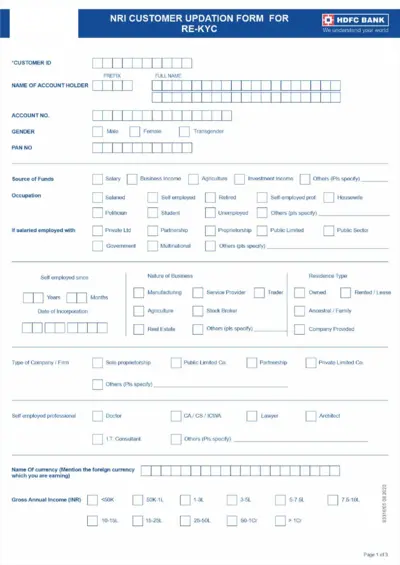

NRI Customer Updation Form for RE-KYC

The NRI Customer Updation Form is essential for Non-Resident Indians to update their KYC details with HDFC Bank. It ensures compliance with regulatory requirements and facilitates banking operations. Completing this form accurately will help maintain the integrity of your account.

Banking

HSBC Standard Personal Information Form

This file is an HSBC Standard Personal Information Form required for customers opening a personal bank account. It collects essential personal, employment, and financial details for due diligence. Fill it out accurately to ensure a smooth account opening process.

Tax Forms

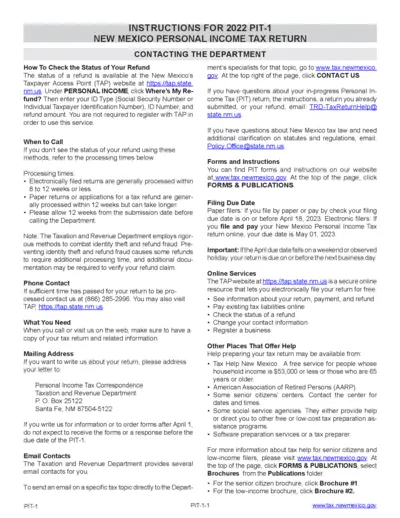

New Mexico Personal Income Tax Return Instructions

This file provides essential instructions for completing the 2022 PIT-1 form for New Mexico personal income tax. It includes contact information, filing deadlines, and guidance for residents and non-residents. Taxpayers can also find resources for assistance and details on military service members' tax obligations.

Banking

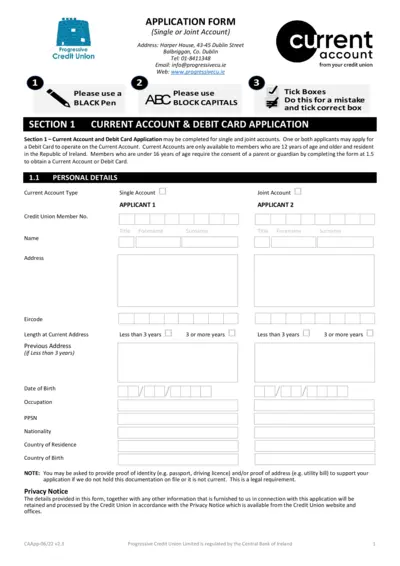

Progressive Credit Union Account Application Form

This form is used to apply for a current account and debit card at Progressive Credit Union. It provides necessary details for both single and joint accounts. Any member aged 12 or older residing in Ireland may apply.

Tax Forms

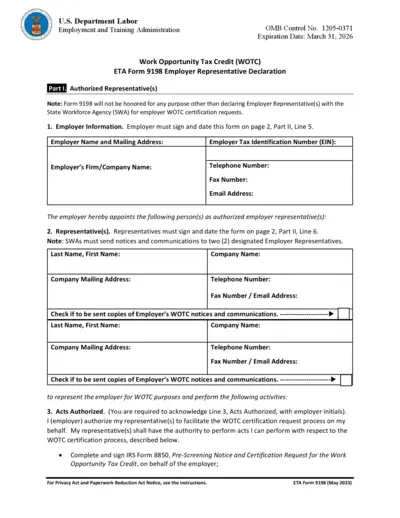

Employer Representative Declaration - WOTC Form 9198

The Employer Representative Declaration Form 9198 allows employers to authorize representatives for Work Opportunity Tax Credit (WOTC) certification requests. This form is essential for employers seeking to navigate the WOTC certification process effectively. By filling out this form, employers can ensure crucial communications regarding WOTC are handled by designated representatives.

Tax Forms

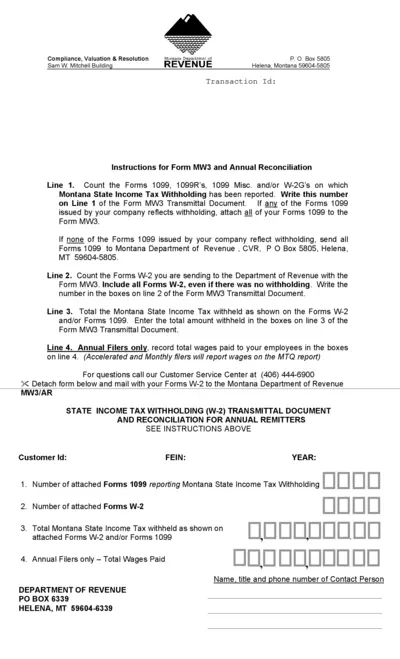

Montana MW3 Withholding Tax Form Instructions

This file provides detailed instructions for completing the Montana MW3 withholding tax form, essential for annual reconciliation. Users will find guidance on reporting taxes withheld from W-2s and 1099 forms. Ensure compliance with state tax requirements by following these steps.

Banking

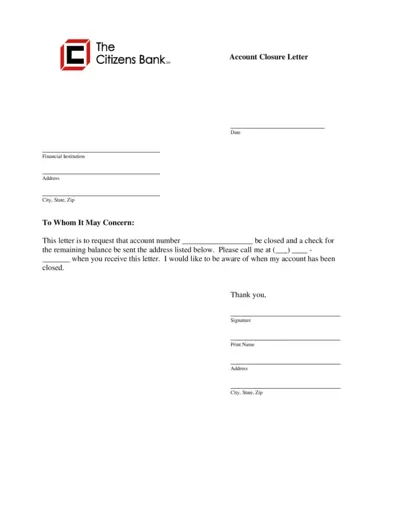

Citizens Bank Account Closure Letter Instructions

This PDF file contains a sample account closure letter to be used when requesting a bank account closure. It's essential for individuals wishing to formally close their bank accounts. Use this template to ensure you include all necessary information in your request.

Tax Forms

IRS Form 8288-A Instructions for Users

This file provides essential instructions for IRS Form 8288-A, used for withholding on certain dispositions by foreign persons. It includes details about the form's components and filing requirements. Ideal for tax professionals and individuals involved in U.S. property transactions.

Tax Forms

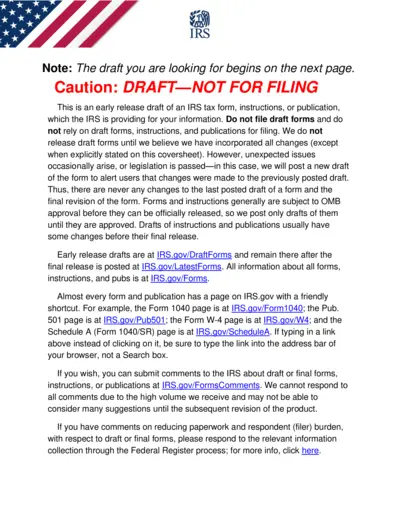

New Jersey Corporation Business Tax Return Guidelines

This document provides comprehensive instructions for filing the New Jersey Corporation Business Tax Return (CBT-100). It outlines electronic filing mandates, eligibility criteria, and details on submissions. Tax preparers and corporations will benefit from following these guidelines.

Banking

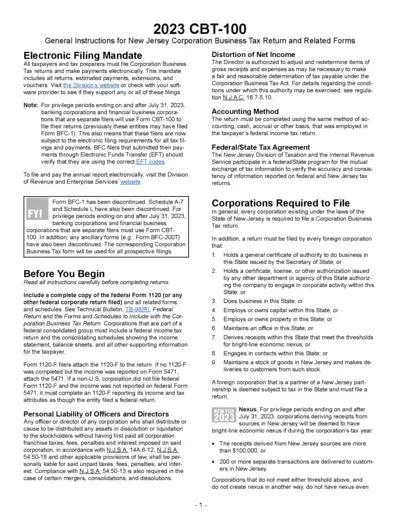

Customer Request Form for Bank Account Modifications

This form allows customers to update their personal details, change account services, and submit requests related to their bank accounts. Users must fill in mandatory fields and provide supporting documents as needed. Ensure to submit the form for prompt processing of your requests.

Tax Forms

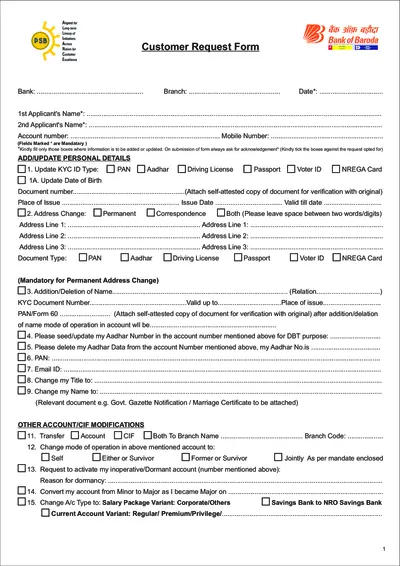

Connecticut Sales and Use Tax Return Form OS-114

Form OS-114 is necessary for reporting sales and use tax in Connecticut. This form must be filed electronically and includes various fields for tax calculations. Proper completion of this return is crucial for compliance with state regulations.