Personal Finance Documents

Banking

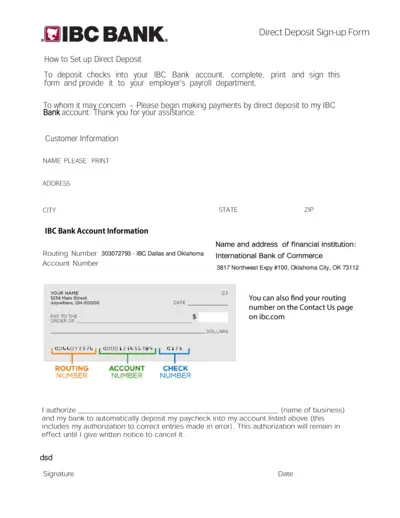

IBC Bank Direct Deposit Sign-up Form Instructions

This file contains detailed information on how to complete the IBC Bank Direct Deposit Sign-up Form. It is essential for depositing checks directly into your bank account. Follow the simple instructions provided to set up your direct deposit seamlessly.

Tax Forms

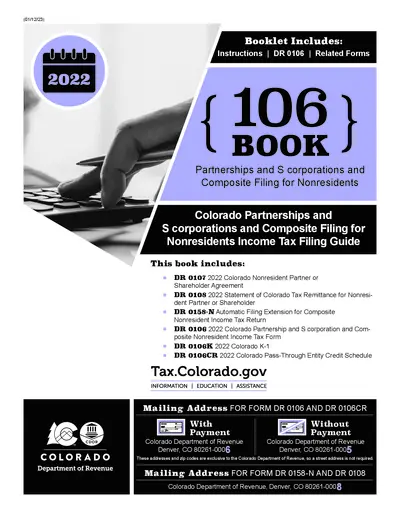

Colorado Nonresident Partner Tax Filing Guide

This guide provides essential instructions for filing the Colorado Nonresident Partner or Shareholder Agreement. It assists users in understanding the necessary requirements and forms needed for compliance. Use this resource to navigate nonresident income tax filing efficiently.

Tax Forms

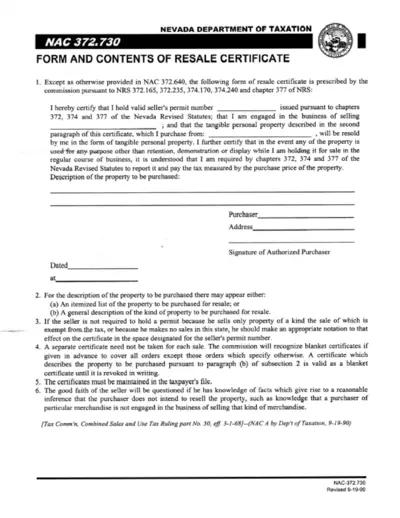

Nevada Resale Certificate Instructions and Details

This file provides guidelines on how to properly fill out the Nevada resale certificate. It ensures compliance with Nevada tax laws when purchasing goods for resale. Use this document to understand the forms and requirements needed for tax exemption.

Tax Forms

IRS Form 8825: Rental Real Estate Income & Expenses

Form 8825 is utilized for reporting rental real estate income and expenses for partnerships or S corporations. It serves as an essential resource for accurate tax reporting. Ensure to follow the instructions carefully to avoid errors.

Tax Forms

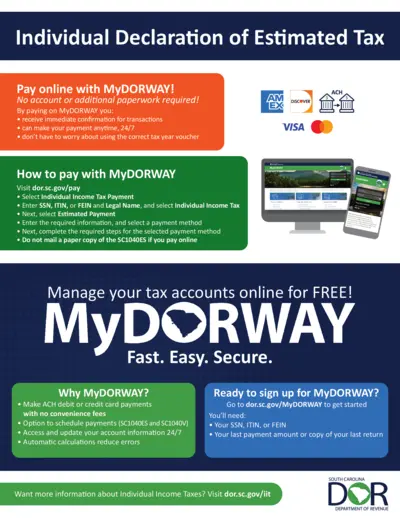

Individual Declaration of Estimated Tax Form SC1040ES

The Individual Declaration of Estimated Tax form is essential for individuals in South Carolina to report their estimated taxes. This form allows users to pay their taxes online easily. Completing this form accurately ensures compliance with tax regulations in South Carolina.

Banking

Truist Bank Services Agreement and Details

This document contains the comprehensive Truist Bank services agreement outlining various account types and rules. It provides essential information about money management and electronic fund transfers. Users will find valuable instructions for account opening, management, and electronic transactions.

Tax Forms

Instructions for Form 8621 Passive Foreign Investment

This file provides comprehensive instructions for filling out Form 8621. It is designed for U.S. shareholders of Passive Foreign Investment Companies (PFICs). Ensure compliance with the latest tax regulations outlined herein.

Tax Forms

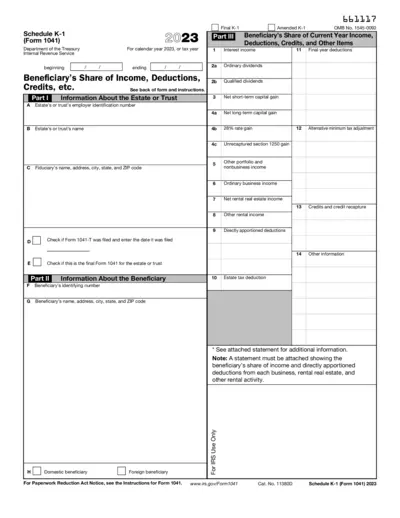

Schedule K-1 Form 1041 2023 Tax Return Instructions

This file provides essential details and instructions for beneficiaries of estates or trusts who receive Schedule K-1 (Form 1041). It outlines how to report income, deductions, and credits on tax returns. Users will find necessary information to accurately complete their tax forms.

Banking

Request for Change of Address Form - Punjab National Bank

This document is the Request for Change of Address Form for Punjab National Bank. It provides information on how cardholders can update their address details. Follow the included instructions for a seamless address change process.

Tax Forms

Indiana Sales Tax Exemption Certificate ST-105

The Indiana Form ST-105 is a General Sales Tax Exemption Certificate utilized by state registered businesses. It enables exempt purchases to support legitimate commercial transactions in compliance with Indiana tax codes. Ensure all sections are completed to validate the exemption.

Banking

Undertaking cum Indemnity for Electronic Execution

This file serves as an undertaking and indemnity for the electronic execution of banking documents. It outlines the responsibilities and liabilities of the account holder when engaging in electronic banking with Meezan Bank. Users must adhere to the guidelines set forth in this document to ensure compliance and security.

Tax Forms

Application Form for Income Tax Convention Relief

This form allows recipients of royalties to claim relief from Japanese Income Tax and Special Income Tax for Reconstruction based on treaties. It's essential for foreign entities receiving payments from Japanese sources. Ensure to follow the detailed instructions while filling out this form to benefit from tax exemptions.