Personal Finance Documents

Tax Forms

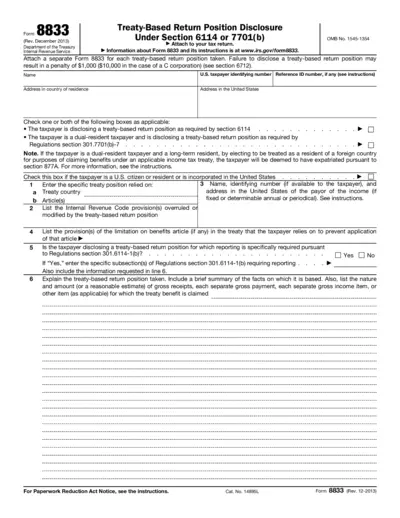

Treaty-Based Return Position Disclosure Instructions

This document provides detailed instructions for filing Form 8833, which is required for treaty-based tax return position disclosures. It is essential for both U.S. taxpayers and dual-resident taxpayers to avoid penalties and ensure compliance. Follow the guidelines to correctly fill out the form and understand your obligations.

Banking

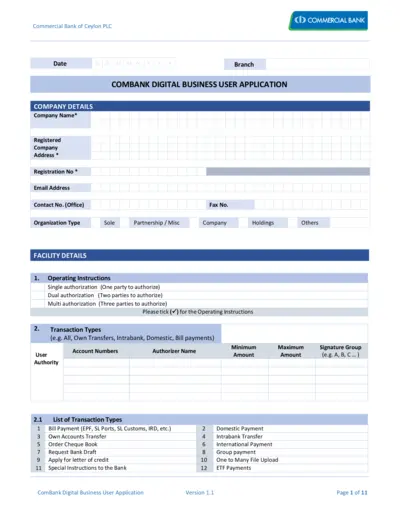

ComBank Digital Business User Application Instructions

This file provides essential information for businesses seeking to apply for the ComBank Digital Business services. It outlines the necessary details, operating instructions, and user requirements. Ensure all fields are filled accurately to facilitate a smooth application process.

Banking

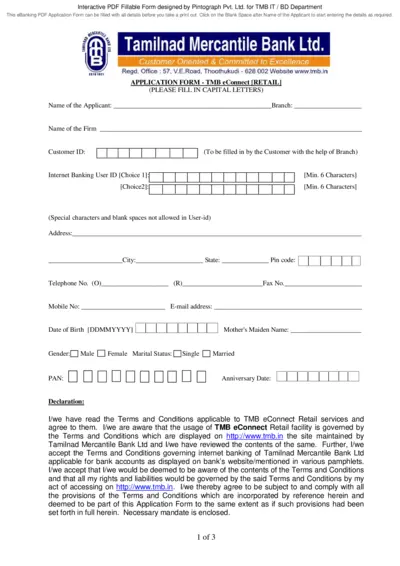

TMB eBanking PDF Application Form Instructions

This interactive eBanking PDF application form by Tamilnad Mercantile Bank allows users to fill out their details online before printing. Perfect for account holders looking to access TMB eConnect services efficiently. Ensure you complete the necessary fields accurately to streamline your application process.

Tax Forms

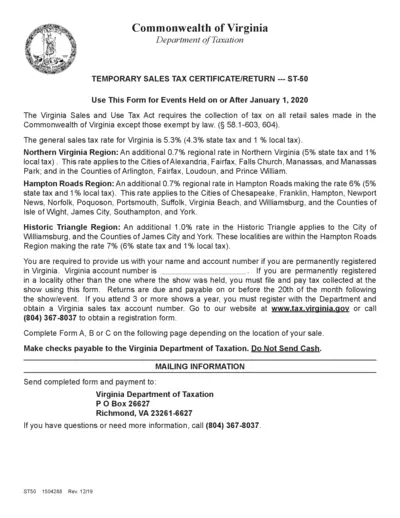

Virginia Temporary Sales Tax Certificate and Return

This file provides the necessary information and forms for the Virginia Temporary Sales Tax Certificate/Return. It is essential for vendors participating in sales events in Virginia. Ensure compliance with the Virginia Sales and Use Tax Act with this convenient guide.

Tax Forms

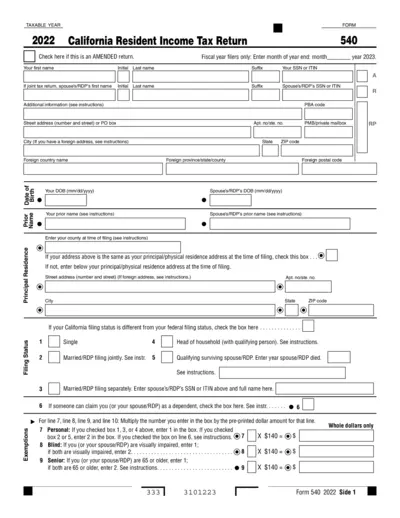

California Resident Income Tax Return 2022

This file contains the 2022 California Resident Income Tax Return for individuals. It provides detailed information on how to properly fill out your tax return. Ensure your compliance with state tax laws using this essential document.

Banking

Central Bank of India Application Form for Services

This application form is for individuals seeking to avail Internet, Mobile, and Tele Banking services from the Central Bank of India. It outlines essential details needed for application and account management. Follow the instructions carefully to ensure successful submission.

Tax Forms

Free Tax USA Form 3800 General Business Credit

This file contains IRS Form 3800 for General Business Credit. It's essential for tax reporting and provides guidance for filling out the form. Users can e-file and print their federal tax return using FreeTaxUSA.

Tax Forms

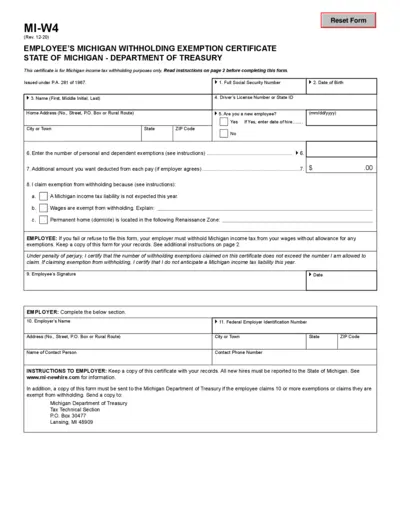

Michigan Withholding Exemption Certificate MI-W4 Form

The Michigan Withholding Exemption Certificate (Form MI-W4) is essential for employees to claim personal and dependent exemptions for state income tax withholding. It outlines the necessary details required for tax purposes and helps determine the correct withholding amount from wages. Understanding how to fill out this form correctly can save you money and ensure compliance with state tax regulations.

Retirement Plans

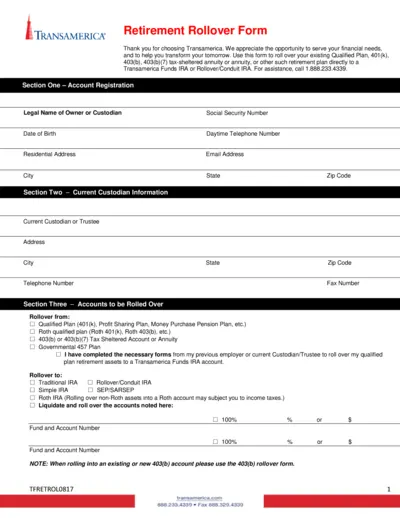

Transamerica Retirement Rollover Form Instructions

This file contains essential information to roll over your retirement funds to a Transamerica IRA. It includes steps to complete the rollover process and important tax withholding details. Use this form to ensure your financial future is secure.

Tax Forms

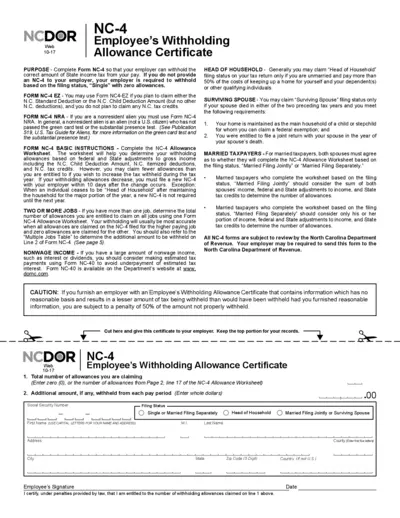

NC-4 Employee Withholding Allowance Certificate

The NC-4 form allows employees to determine the correct amount of State income tax withheld from their pay. Users can complete this form to make informed decisions regarding withholding allowances. It is essential for both individuals and employers to understand this form for accurate tax withholding.

Banking

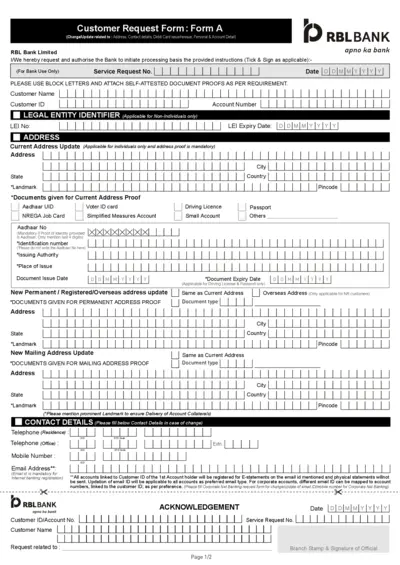

Customer Request Form - RBL Bank Transactions

This form allows customers to make changes to their account details, including address and contact information. It also provides options for debit card issuance and updates. Ensure all necessary proofs are attached for processing.

Tax Forms

Instructions for IRS Form W-7 Application ITIN

This document provides detailed instructions for completing the IRS Form W-7, which is necessary for applying for an Individual Taxpayer Identification Number (ITIN). It outlines eligibility, application procedures, and documentation requirements. Understanding these guidelines is crucial for individuals needing an ITIN for tax purposes.