Personal Finance Documents

Banking

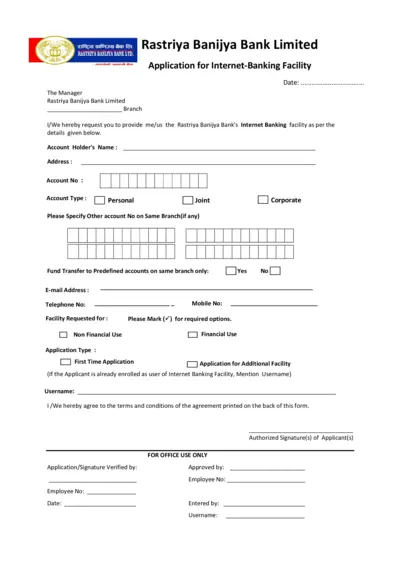

Rastriya Banijya Bank Application for Internet Banking

This file is an application form for Internet Banking at Rastriya Banijya Bank. It includes fields for personal information and account details necessary for the application process. The document outlines terms and conditions for the Internet Banking service.

Estate Planning

Personal Information Record for Estate Planning

This file serves as a comprehensive personal information record important for estate planning. It helps ensure that your family and close friends can easily locate essential documents and understand your wishes. Filling out this record can provide peace of mind and clarity regarding your personal affairs.

Tax Forms

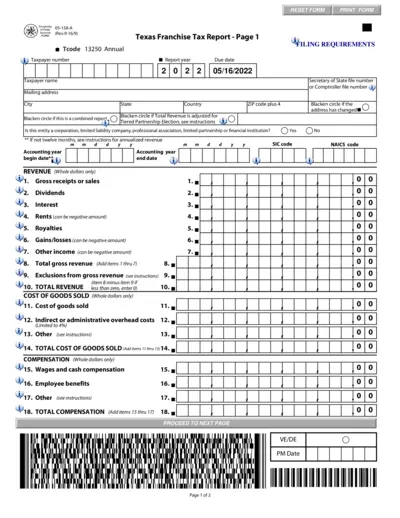

Texas Franchise Tax Report - Form 05-158

The Texas Franchise Tax Report Form 05-158 is essential for businesses to report their financial data to the Texas Comptroller. This document helps in calculating the franchise tax owed by the entity for the reported year. Accurate submission ensures compliance with state tax regulations.

Banking

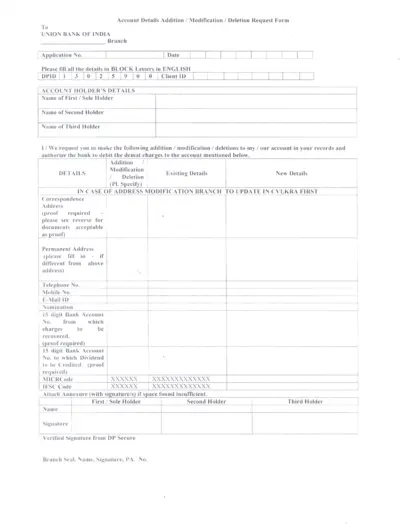

Account Details Modification Request Form

This file is designed for users who need to modify their account details with Union Bank of India. It allows for the submission of additions, modifications, or deletions in account information. The form requires the user's basic details and supporting documents for processing.

Tax Forms

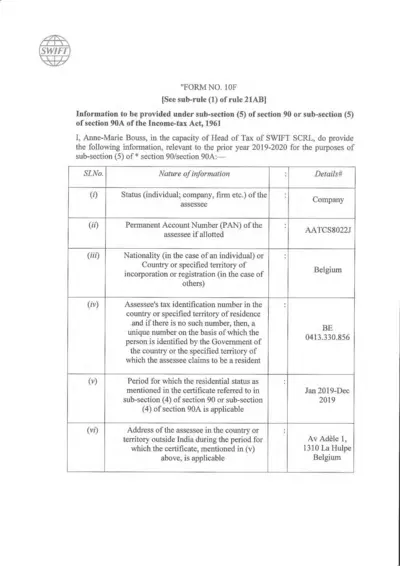

Form No. 10F Information Submission

This document provides essential information as required by the Income-tax Act, 1961. It is relevant for individuals and entities seeking tax residency status. Fill out this form accurately to ensure compliance with tax regulations.

Tax Forms

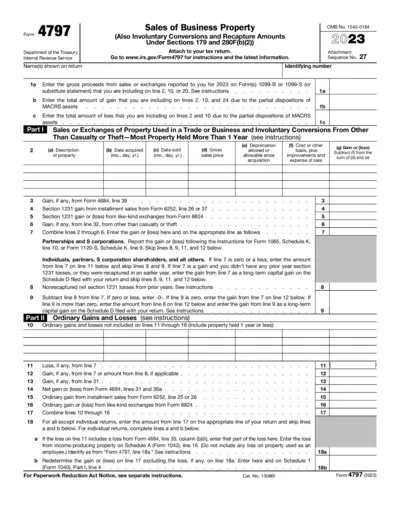

Form 4797: Sales of Business Property Instructions

Form 4797 provides guidelines for reporting sales of business property. This form is crucial for calculating gains and losses related to sales, exchanges, and involuntary conversions. Properly filling out this form ensures compliance with IRS regulations and accurate reporting on your tax return.

Tax Forms

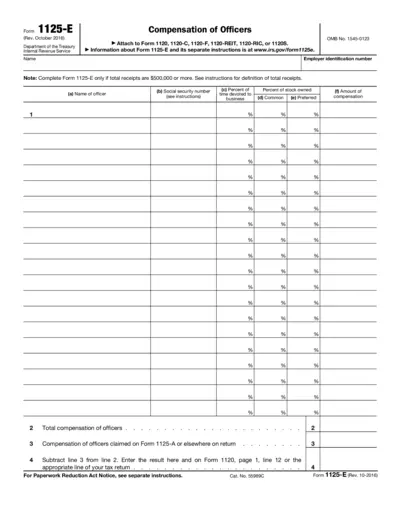

Form 1125-E Compensation of Officers Instructions

Form 1125-E is used for reporting officer compensation.

Tax Forms

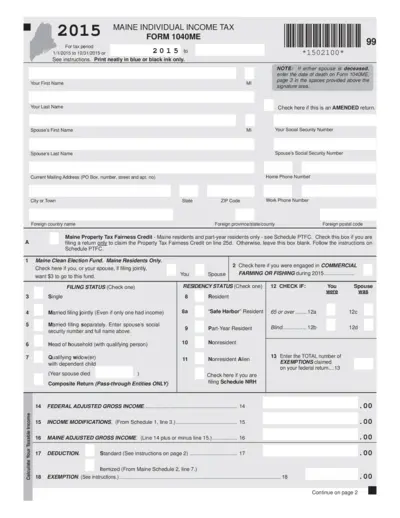

Maine Individual Income Tax Form 1040ME Instructions

This document provides a comprehensive guide for filling out the Maine Individual Income Tax Form 1040ME. It includes crucial deadlines, filing statuses, and step-by-step instructions. Use this form for your income tax filing needs in the state of Maine.

Debt Management

Pay for Delete Letter Template Guide

This Pay for Delete letter template is designed to help you negotiate with collection agencies. By using this template, you can craft a professional letter to dispute debts and propose settlements. It's an essential tool for anyone looking to clean up their credit report.

Tax Forms

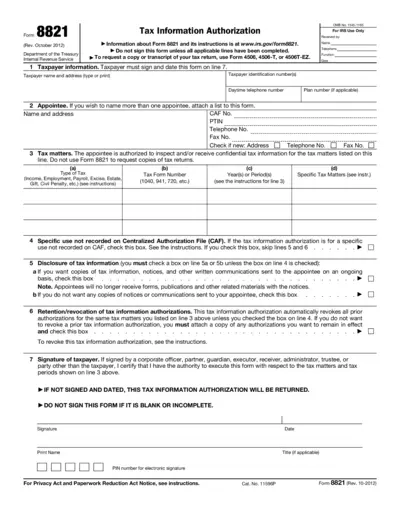

Form 8821 Tax Information Authorization

Form 8821 allows you to authorize an individual or entity to inspect and receive your confidential tax information. It is essential for managing your tax matters effectively. This form outlines the permissions granted and ensures proper handling of your tax data.

Banking

Bank of America Estate Services Guide After Loss

This file provides crucial information regarding the management of banking relationships following a loss, offering support and guidance. It includes key questions about documents needed when a customer passes away and how to process them. Reach out for personalized assistance tailored to your banking needs.

Tax Forms

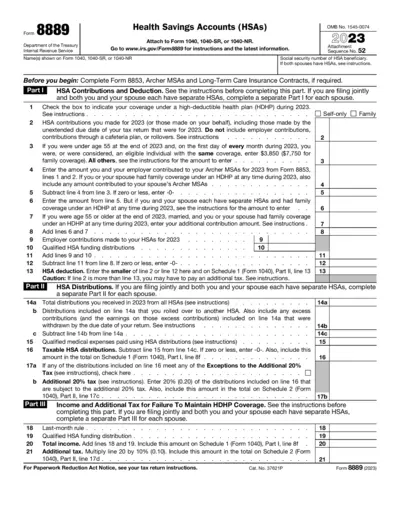

Form 8889 Health Savings Account IRS Instructions

Form 8889 is used to report Health Savings Account (HSA) contributions, deductions, and distributions. This form is crucial for individuals with HSAs to ensure compliance with IRS regulations. It provides necessary information for calculating tax benefits related to HSAs.