Personal Finance Documents

Banking

Huntington Consumer Deposit Account Agreement

This document provides detailed information regarding the Huntington Consumer Deposit Account Agreement. It outlines how your deposit account functions and the various terms associated with it. Understanding this agreement is crucial for managing your account effectively.

Banking

BDO Business Online Banking Instructions

This file provides comprehensive guidelines for businesses using BDO's Online Banking Service. It includes terms, responsibilities, and procedural steps for account management. Ideal for authorized representatives and company executives.

Loans

Prime Minister's Youth Loan Scheme Instructions

This file contains vital information regarding the Prime Minister's Youth Business and Agriculture Loan Scheme. It provides details about eligibility, loan sizes, and how to fill out the application. Perfect for young entrepreneurs looking for financial assistance in Pakistan.

Tax Forms

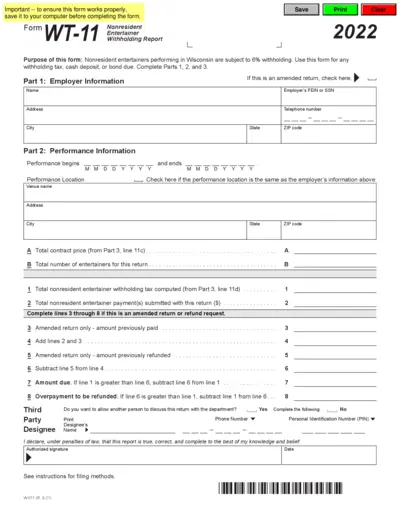

WT-11 Nonresident Entertainer Withholding Report

The WT-11 form is designed for nonresident entertainers performing in Wisconsin. It enables users to report withholding tax accurately. This essential document ensures compliance with state tax laws.

Tax Forms

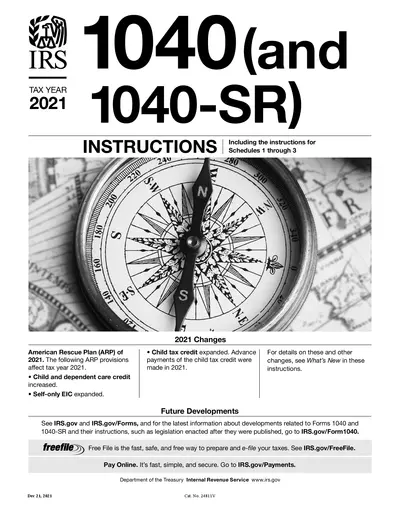

IRS 1040 Tax Form Instructions for 2021

This file contains the IRS instructions for tax form 1040 and 1040-SR for the tax year 2021. It includes updates from the American Rescue Plan and provides essential filing requirements. Users will find detailed sections on filling out the form, necessary schedules, and important information for tax preparation.

Tax Forms

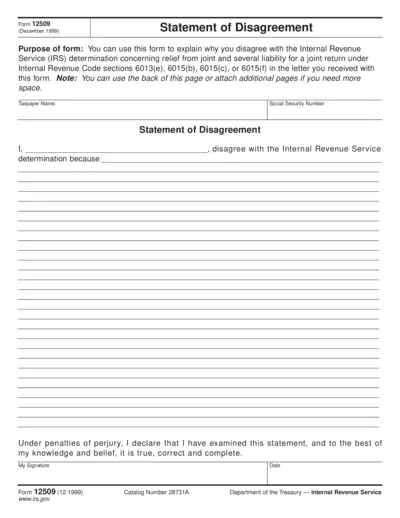

Form 12509 Statement of Disagreement for IRS

Form 12509 allows taxpayers to contest IRS determinations regarding joint return liability. Use this form to present your explanation clearly. It's essential for those seeking relief under IRS regulations.

Tax Forms

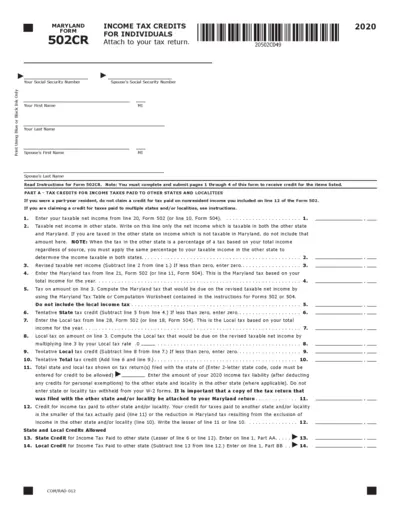

Maryland Form 502CR Income Tax Credits 2020

Maryland Form 502CR provides individuals with essential income tax credits applicable for the year 2020. This form assists in determining credits for taxes paid to other states and localities, child and dependent care expenses, and more. Ensure to attach this form to your tax return for proper credit assessment.

Tax Forms

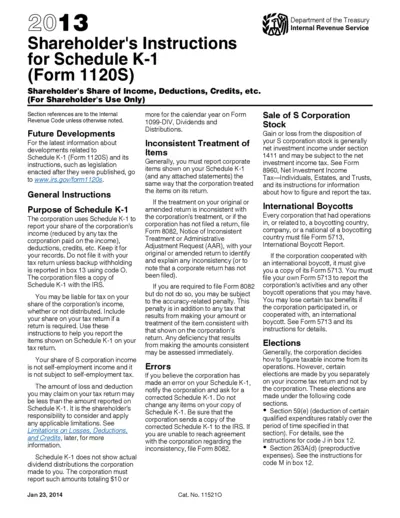

Shareholder's Instructions for Schedule K-1 (Form 1120S)

This file provides detailed instructions for shareholders on how to fill out Schedule K-1 (Form 1120S). It includes vital information regarding reporting your share of a corporation's income, deductions, and credits. Designed for S corporations, this guide ensures accurate tax reporting for shareholders.

Tax Forms

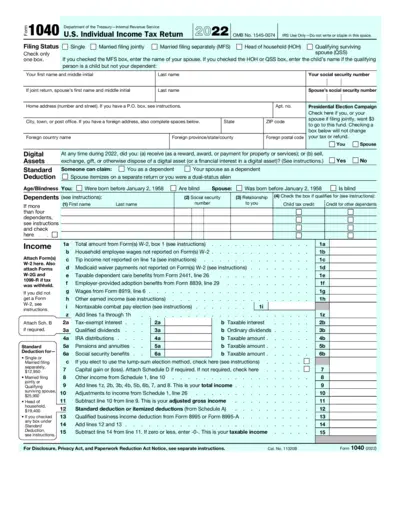

U.S. Individual Income Tax Return Form 1040 2022

The U.S. Individual Income Tax Return Form 1040 for the year 2022 is essential for individuals reporting their annual income to the IRS. This form determines filing status, calculates tax obligations, and claims deductions. Proper completion is vital to ensure accurate tax processing and compliance.

Banking

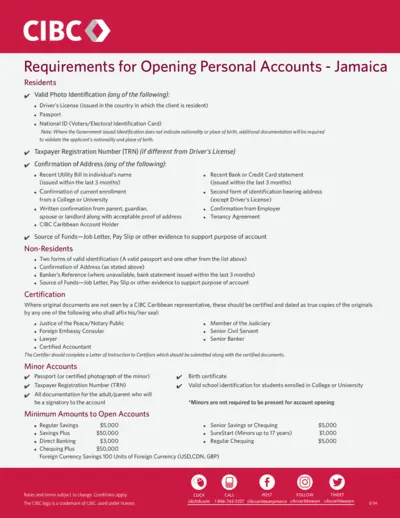

CIBC Personal Accounts Requirements for Jamaica

This document outlines the requirements for opening personal accounts at CIBC in Jamaica. It details the necessary identification and documentation for residents and non-residents. Essential for anyone planning to open a bank account with CIBC.

Banking

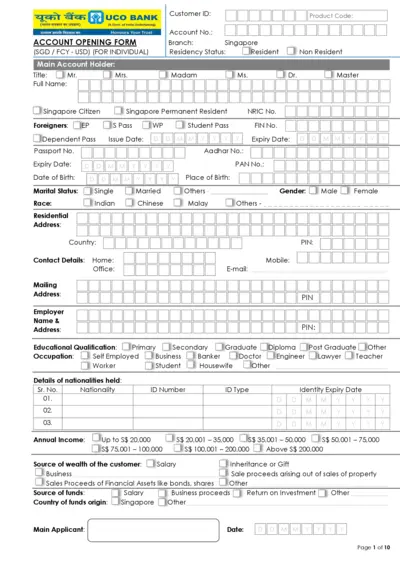

UCO Bank Account Opening Form for Individuals

This document is the account opening form for UCO Bank. It is designed for individuals to provide necessary details for account setup. Complete this form accurately to ensure a smooth account opening process.

Retirement Plans

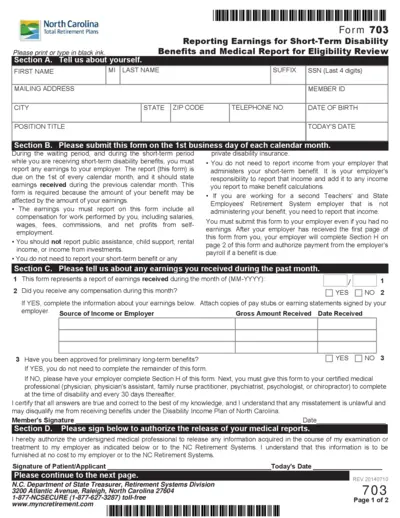

North Carolina Total Retirement Plans Form 703

This file provides essential information and instructions for filling out the North Carolina Total Retirement Plans Form 703 related to short-term disability benefits. Users must report any earnings while receiving these benefits each month. It is crucial for maintaining eligibility for benefits.