Personal Finance Documents

Tax Forms

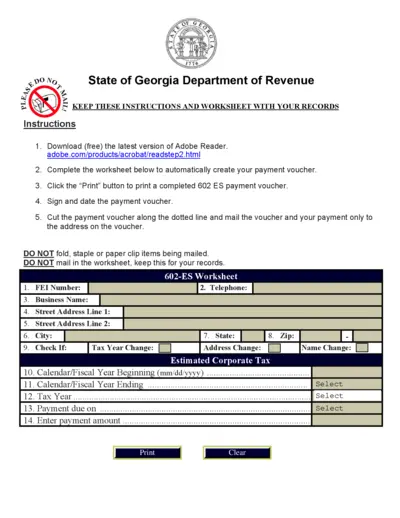

Georgia Department of Revenue Estimated Tax Form

This file provides important instructions and a worksheet for completing the Georgia Department of Revenue's Estimated Tax Form. Follow the steps to ensure your payments are processed correctly. It includes contact information and guidance for corporations filing estimated tax.

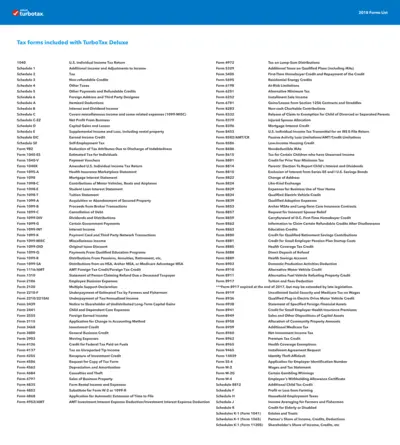

Tax Forms

TurboTax Deluxe Tax Forms and Instructions

This file contains essential tax forms included with TurboTax Deluxe. It provides users with the necessary documentation for filing their U.S. income taxes. This comprehensive guide is a valuable resource for both individual taxpayers and tax professionals.

Banking

Chase Connect User Guide for Domestic and International Wires

This user guide provides comprehensive instructions on using Chase Connect for domestic and international wire transfers. Users can easily navigate through the process of adding recipients, scheduling wires, and managing payment activities. A handy glossary and FAQs section are also included for additional support.

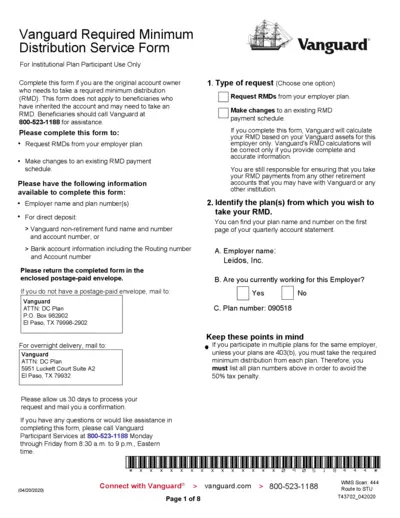

Retirement Plans

Vanguard Required Minimum Distribution Service Form

This form is essential for institutional plan participants to request their required minimum distributions. It provides clear guidance on how to complete the RMD request accurately. Ensure you follow the instructions to avoid penalties and ensure timely processing.

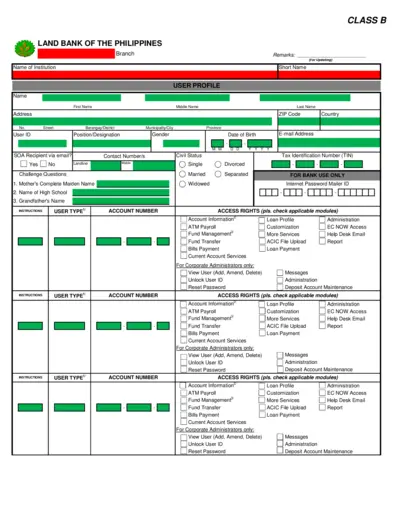

Banking

LANDBANK User Profile and Instructions Form

This file contains the user profile form for LANDBANK. It includes detailed instructions for filling out the form accurately. Ideal for users who need assistance in account management and access.

Tax Forms

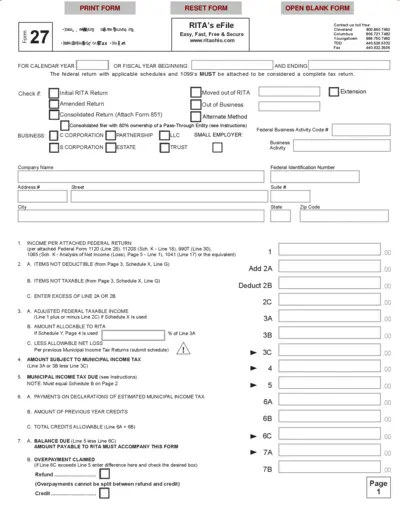

RITA Tax Form 27 Instructions and Guidelines

This file contains the necessary instructions for filling out RITA Form 27. It is essential for tax compliance for residents and businesses. Follow these detailed guidelines to ensure accurate submission.

Tax Forms

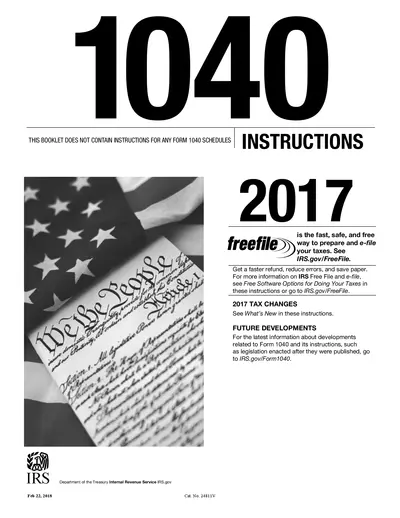

Instructions for IRS Form 1040 for 2017 Tax Year

This file contains comprehensive instructions for filling out IRS Form 1040 for the 2017 tax year. It details filing requirements, tax changes, and guidance from the Taxpayer Advocate Service. Essential for taxpayers looking to understand their obligations and benefits when filing taxes.

Tax Forms

IRS Schedule 8812 Child Tax Credit Form 2024

The IRS Schedule 8812 is used for claiming the Child Tax Credit and Credit for Other Dependents. It provides guidance on the credits available to qualifying families. Ensure you understand the eligibility criteria and instructions before filing.

Tax Forms

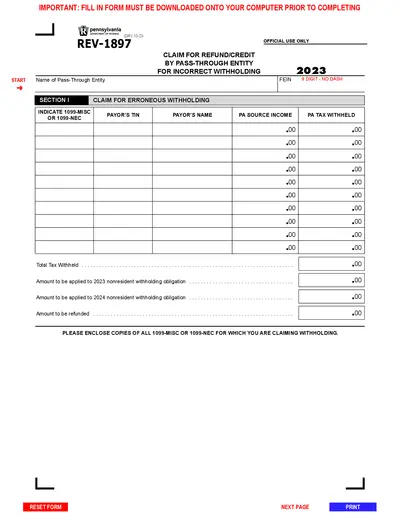

Pennsylvania Department of Revenue REV-1897 Tax Form

The REV-1897 form is essential for pass-through entities in Pennsylvania to claim a refund or credit for erroneous withholding. It is necessary for those who have had Pennsylvania tax withheld incorrectly on their behalf. Completing this form ensures proper processing of your tax obligations.

Tax Forms

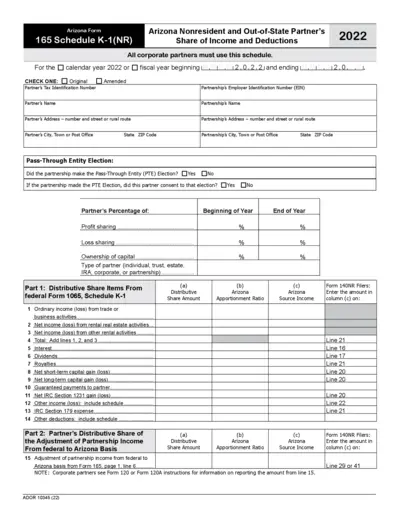

Arizona Form 165 Schedule K-1 (NR) Instructions

This document provides detailed instructions for completing the Arizona Form 165 Schedule K-1 for nonresident partners. It outlines all required fields and necessary information for accurate filing. Get guidance on how to report distributive shares and adjustments of partnership income.

Banking

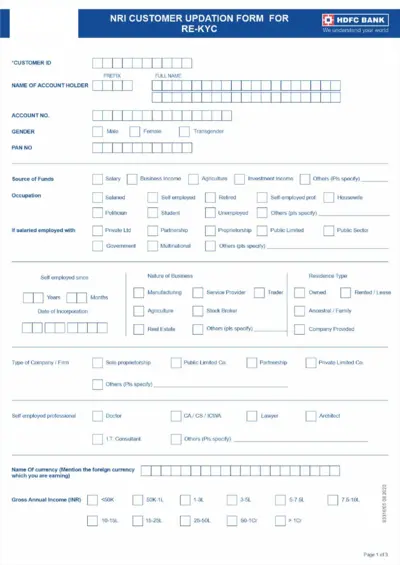

NRI Customer Updation Form for Re-KYC

This file contains the NRI Customer Updation Form required for Re-KYC at HDFC Bank. It includes all necessary details and documentation requirements for non-resident Indians. Ensure to fill it out accurately to avoid any issues.

Tax Forms

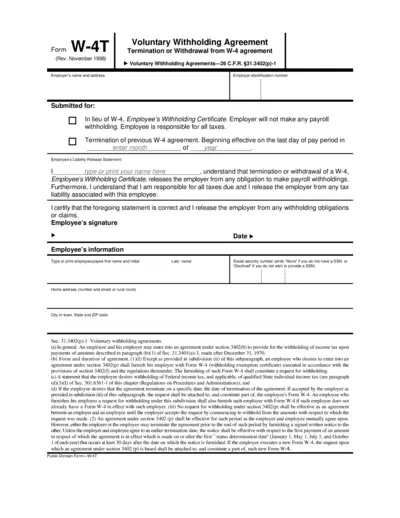

Form W-4T Voluntary Withholding Agreement

The Form W-4T is used by employees to request voluntary withholding of income taxes. It helps employers determine the correct amount to withhold from employees' payments. It's essential for managing tax obligations effectively.