Personal Finance Documents

Banking

Chase Connect User Guide for Online Services

This user guide provides detailed instructions on how to view statements and check images using Chase Connect. Ideal for both personal and business account holders, it outlines various online services and management options. Learn to navigate your accounts efficiently with this comprehensive resource.

Tax Forms

Preparation and Routing Instructions for Form 3870

This document provides detailed instructions for completing Form 3870. It's essential for taxpayers and their authorized representatives. Fill it out correctly to ensure proper processing of your tax adjustments.

Banking

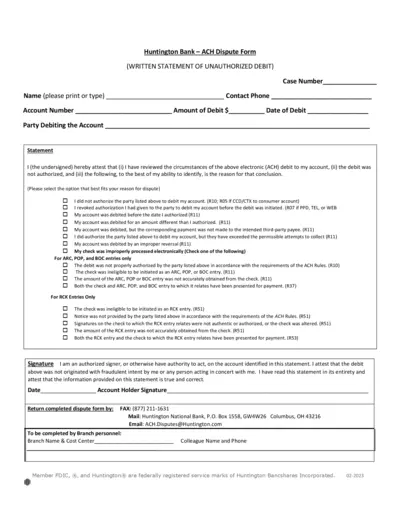

Huntington Bank ACH Dispute Form Instructions

This document is the official ACH Dispute Form for Huntington Bank. It provides users with guidance on disputing unauthorized transactions. Use this form to formally contest an ACH debit that you believe was not authorized.

Tax Forms

Georgia Form 500 Individual Income Tax Return

The Georgia Form 500 is the Individual Income Tax Return for residents and nonresidents. This document is essential for filing state taxes in Georgia. Ensure you complete the form accurately to avoid issues with the Georgia Department of Revenue.

Banking

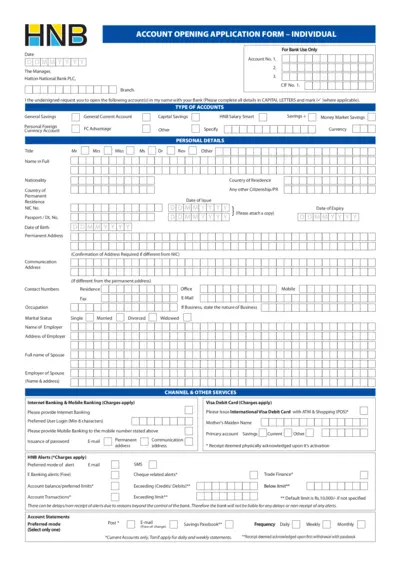

HNB Account Opening Application Form for Individuals

This file contains the application form to open an account with Hatton National Bank for individual clients. It includes detailed instructions and information requirements for account types and personal details. Use this form to initiate your banking relationship with HNB and ensure you have all necessary documentation.

Tax Forms

2023 Oregon Individual Income Tax Return Form OR-40

The 2023 Form OR-40 is designed for Oregon residents filing their individual income tax returns. It provides a comprehensive guide to reporting income, deductions, and credits effectively. Use this form to ensure compliance with Oregon tax regulations while maximizing potential refunds.

Tax Forms

File Submission Guidelines for NYC-1127 Tax Return

This file contains essential instructions and answers related to the NYC-1127 tax return. It helps New York City employees understand their filing obligations and procedures. The document is crucial for non-residents of NYC who need to file their tax returns accurately.

Tax Forms

Form 8655 Reporting Agent Authorization Instructions

Form 8655 allows taxpayers to authorize a reporting agent to sign and file certain tax returns. It is essential for timely and accurate tax filings. This form simplifies the tax process for businesses and individuals utilizing a reporting agent.

Banking

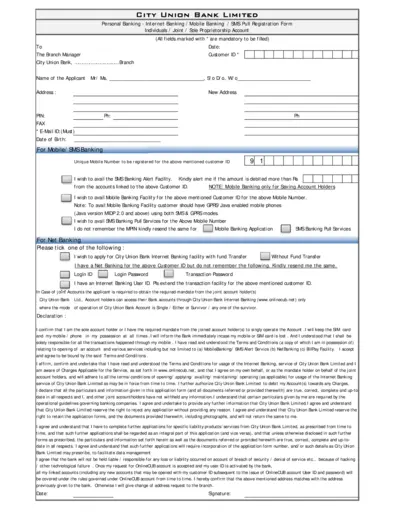

City Union Bank Mobile and Internet Banking Form

This form is intended for individuals and joint account holders seeking to register for mobile and internet banking services with City Union Bank. It includes sections for customer identification, service selection, and declarations of understanding of terms. Follow the instructions to complete and submit the form accurately.

Tax Forms

IRS Form 5498 Instructions and Information

This file contains detailed instructions for filling out IRS Form 5498. It includes vital information for IRA contributions, rollovers, and account values. Users can find guidance on ordering the official form and e-filing options.

Tax Forms

IRS Tax Notice Letter 2645C Sample Template

This file provides a sample of the IRS Tax Notice Letter 2645C. It includes essential details on how to respond and complete the necessary actions regarding your tax issues. Use this template to ensure appropriate and timely correspondence with the IRS.

Tax Forms

SCHEDULE G Form 8865 Gain Deferral Method

This document provides instructions on Form 8865, Schedule G, used to report the application of the gain deferral method under Section 721(c). It is essential for partnerships engaged in transactions involving Section 721(c) property. Ensure you follow IRS guidelines while filling out this form.