Personal Finance Documents

Tax Forms

North Dakota Individual Income Tax Return Form ND-1

This file contains the North Dakota Individual Income Tax Return Form ND-1 for tax filers. It provides essential filing information, guidelines, and specifications crucial for accurate tax submission. Use this form to report your income and calculate your tax liability effectively.

Banking

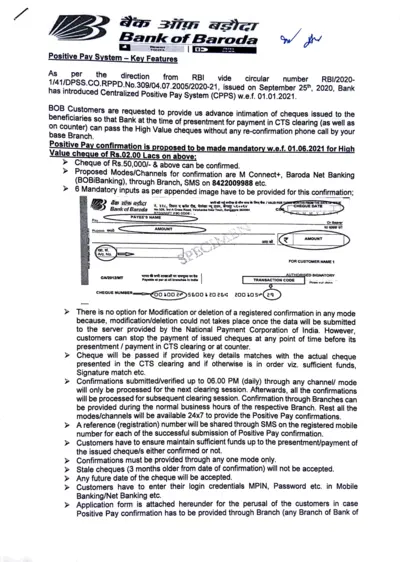

Bank of Baroda Positive Pay System Instructions

This file provides detailed instructions for the Centralized Positive Pay System introduced by Bank of Baroda. Customers are guided on how to confirm high value cheques through various channels. It is essential for account holders to understand the requirements and procedures to ensure smooth transactions.

Tax Forms

IRS Form W-2C Corrected Wage and Tax Statement

The IRS Form W-2C is used to correct errors on previously filed Forms W-2. This form is essential for ensuring accurate tax reporting. Employers must complete this form to amend wage and tax information for employees.

Tax Forms

W-9 Taxpayer Identification Number Request Form

The W-9 form is used to provide your taxpayer identification number to requesters. This form is essential for individuals and entities receiving income. It helps ensure that the right information is reported for tax purposes.

Banking

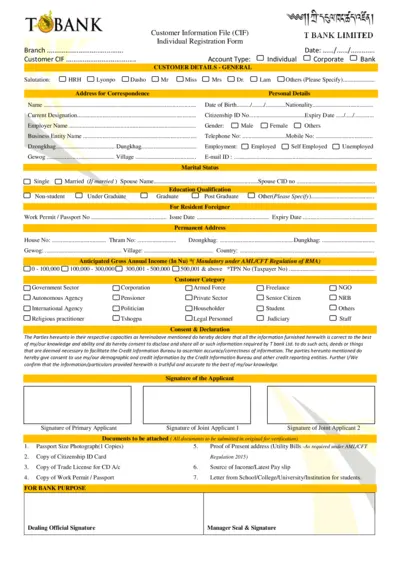

T Bank Account Opening and Legal Claim Forms

This file contains the account opening forms and legal claim nomination form for T Bank Limited. It provides detailed information required for individual registration, including customer details, declaration, and documents needed. This is essential for anyone looking to open an account or nominate a beneficiary at T Bank.

Tax Forms

NY State Form IT-214 Instructions for Tax Credit

This file contains comprehensive instructions for filling out Form IT-214 to claim the Real Property Tax Credit for Homeowners and Renters in New York State. It details eligibility criteria, filing instructions, and important deadlines. Understanding these guidelines will help you maximize your tax credit benefit effectively.

Tax Forms

1040EZ Tax Form Instructions for Simplified Filing

The 1040EZ tax form provides easy instructions for filing your taxes electronically. It is ideal for individuals with simple tax situations. Follow the guidelines included to ensure accurate submissions and maximize your refund.

Tax Forms

Sales and Use Tax Returns Instructions - Florida

This document provides detailed instructions for filing the Florida Sales and Use Tax Return (DR-15). It outlines lawful deductions, tax due calculations, and important filing deadlines. Useful for both individuals and businesses in compliance.

Tax Forms

Form 2555 Instructions for Foreign Earned Income

Form 2555 is used by U.S. Citizens and Resident Aliens to report foreign earned income. It allows individuals to claim the foreign earned income exclusion and housing exclusion or deduction. This form is essential for those working abroad to accurately report their income for tax purposes.

Banking

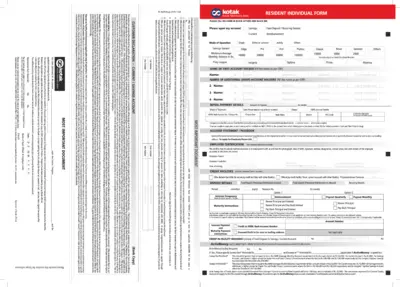

Kotak Mahindra Bank Account Opening Form Instructions

This document provides comprehensive instructions for opening a savings or current account with Kotak Mahindra Bank. It explains the necessary steps, required fields, and the importance of the information provided. Users will also find guidance on filling this form accurately and efficiently.

Loans

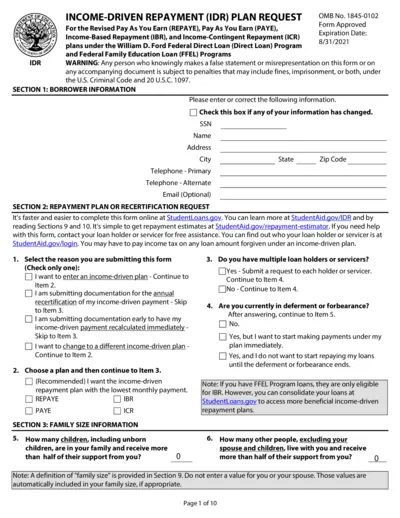

Income-Driven Repayment (IDR) Plan Request

This file is essential for borrowers who need to apply for an income-driven repayment plan. It outlines the necessary information and steps to complete your request. Use this guide to ensure you fill in all required fields correctly and efficiently.

Tax Forms

Arizona Form 321 - Credit for Charitable Contributions

Arizona Form 321 allows taxpayers to claim credits for contributions made to qualifying charitable organizations. This form is essential for those looking to receive tax advantages in the year 2022. Ensure to fill it out accurately to maximize your eligible credits.