Personal Finance Documents

Tax Forms

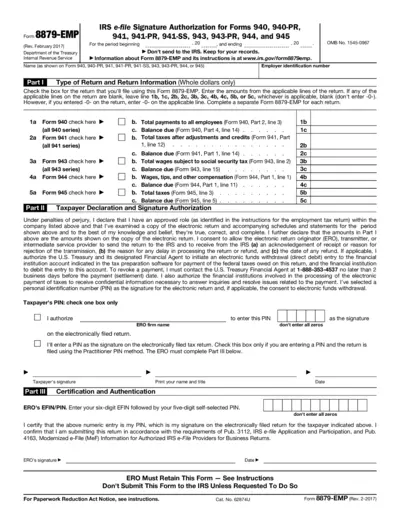

Form 8879-EMP IRS e-file Signature Authorization

Form 8879-EMP is used for the IRS e-file signature authorization of employment tax returns. This form allows taxpayers to electronically sign their returns with a PIN. It serves as an important document for employers to ensure compliance with federal tax regulations.

Banking

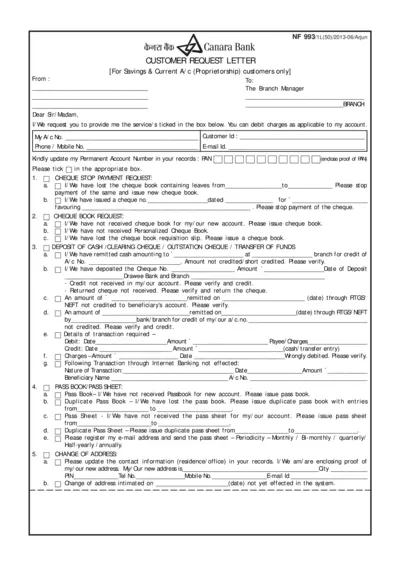

Canara Bank Customer Request Letter Form

This form is a customer request letter for Canara Bank, intended for Savings and Current Account proprietorship customers. It covers various requests such as cheque book issuance, address changes, and more. Use this document to formally submit your requests to the bank.

Investment Accounts

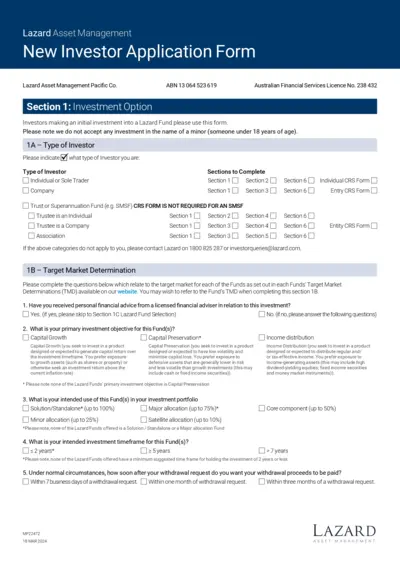

Lazard Asset Management New Investor Application Form

This file is the New Investor Application Form for Lazard Asset Management. It includes essential information for new investors looking to invest in Lazard funds. The application guides users through the investment options and necessary documentation.

Banking

Bank of America Remote Deposit Online Guide

This comprehensive guide provides detailed instructions on using the Bank of America Remote Deposit Service online, ensuring users can maximize its benefits effortlessly. It includes essential information about setup, operational support, and user tips. Ideal for both new and existing users to optimize their deposit processes.

Tax Forms

California Installment Agreement Request Form

This document is the California Franchise Tax Board Installment Agreement Request form, used for requesting a payment plan for tax liabilities. It outlines the conditions for installment agreements and necessary taxpayer agreements. Use this form if you are unable to pay your tax liability in full immediately.

Tax Forms

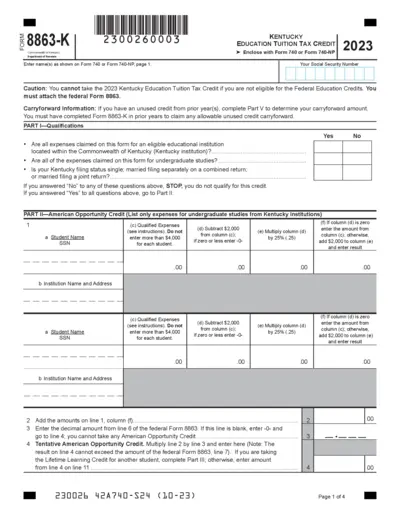

Kentucky Education Tuition Tax Credit Form 8863-K

Form 8863-K is essential for claiming the Kentucky Education Tuition Tax Credit. It details guidelines and qualifications for eligible taxpayers. Complete this form to potentially reduce your tax liability in Kentucky.

Banking

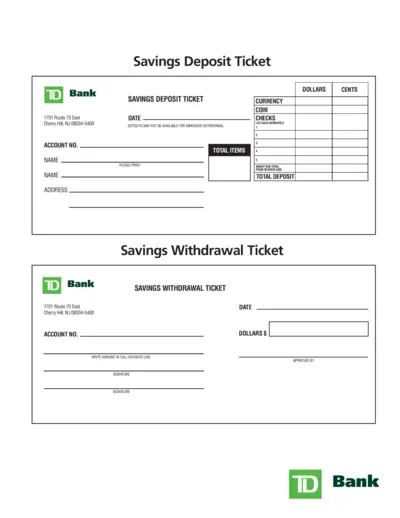

TD Bank Deposit and Withdrawal Forms

This file contains essential forms for depositing and withdrawing savings at TD Bank. Users can fill out deposit and withdrawal tickets accurately. It serves as a handy reference for managing savings transactions.

Tax Forms

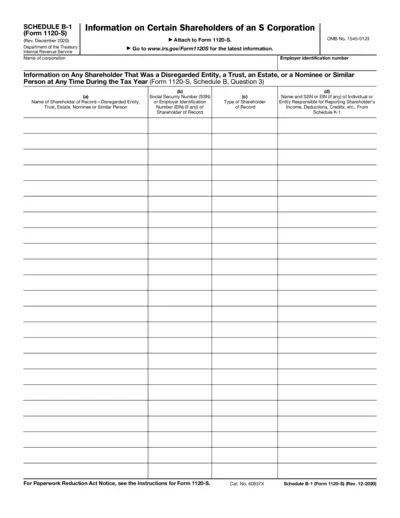

Form 1120-S Schedule B-1 Details and Instructions

Form 1120-S Schedule B-1 provides essential instructions for S corporations regarding certain shareholders. It details the necessary information required for filing and the specific conditions applicable to various types of shareholders. This document is crucial for ensuring compliance with IRS regulations.

Tax Forms

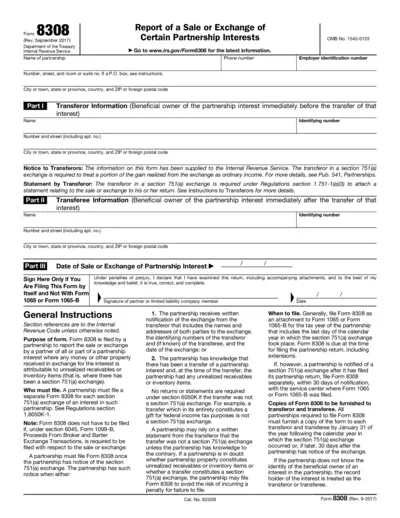

Form 8308 Report of Sale or Exchange of Partnership Interests

Form 8308 is utilized by partnerships to report the sale or exchange of partnership interests that may involve unrealized receivables or inventory items. It is essential for proper tax reporting and compliance with IRS regulations. This form requires detailed information about transferors, transferees, and the specifics of the transaction.

Tax Forms

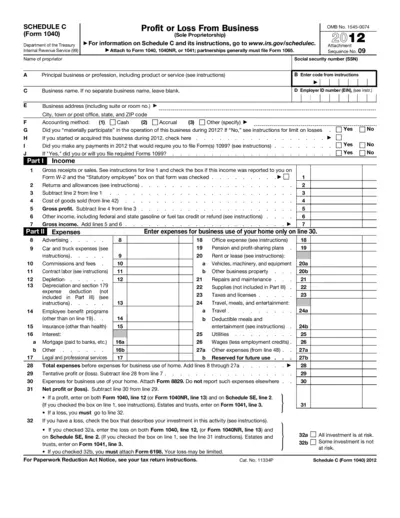

Schedule C Form 1040 Profit or Loss Business

This file is essential for sole proprietors to report income and expenses from their business. Sectioned into parts, it includes detailed calculations on profits and losses. Easily download and fill out this IRS form to ensure accurate tax filings.

Banking

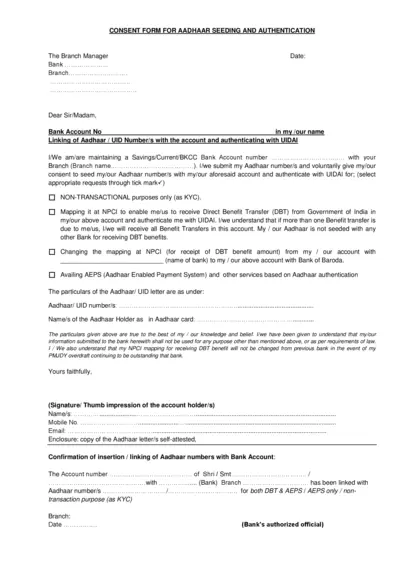

Consent Form for Aadhaar Seeding and Authentication

This Consent Form allows individuals to link their Aadhaar numbers with their bank accounts for KYC purposes. It facilitates Direct Benefit Transfer from the Government of India. Ensure proper authentication with UIDAI for smooth financial transactions.

Banking

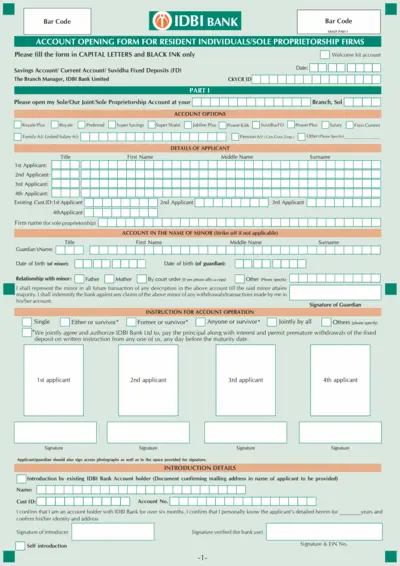

Account Opening Form for IDBI Bank - Resident Individuals

This document is the account opening form for residents individuals and sole proprietorship firms at IDBI Bank. It provides all necessary details and instructions required to open an account. Ensure to fill the form accurately to facilitate a smooth account opening process.