Personal Finance Documents

Tax Forms

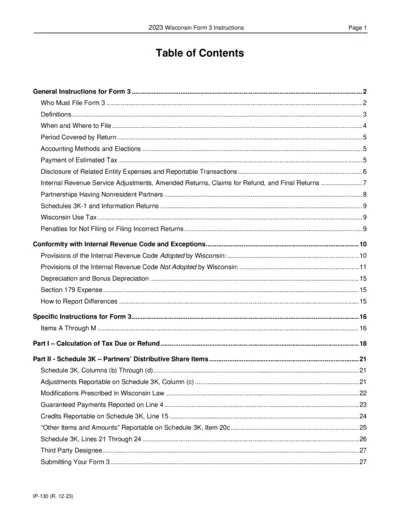

2023 Wisconsin Form 3 Instructions and Guidelines

This document provides detailed instructions for completing Wisconsin Form 3, intended for partnerships and LLCs. It includes information on filing requirements, definitions, and calculations relevant to the form. Users will find guidance on necessary schedules and what to expect when filing.

Tax Forms

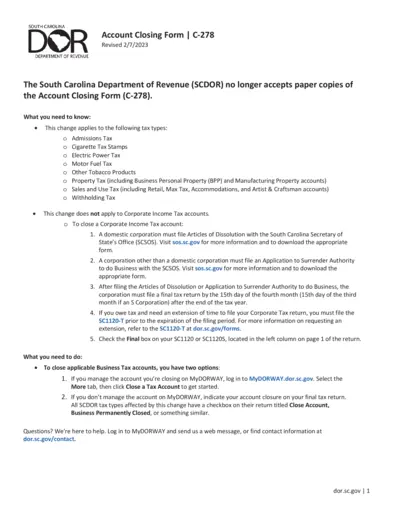

South Carolina Account Closing Form C-278 Instructions

The South Carolina Account Closing Form (C-278) is essential for businesses looking to close their tax accounts. This form ensures compliance with state regulations set by the Department of Revenue. Learn about the steps and requirements for submitting this important form.

Tax Forms

IRS Schedule C Form 1040 Instructions

The IRS Schedule C (Form 1040) provides profit or loss information for business proprietors. Learn how to accurately complete this tax form for the 2024 tax year. Essential guidelines for filing correctly and meeting regulatory requirements.

Tax Forms

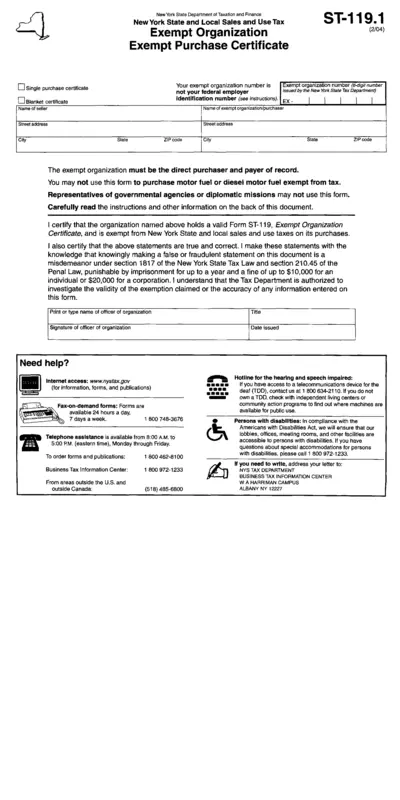

New York Sales Tax Exempt Purchase Certificate ST-119.1

This file is the New York Sales Tax Exempt Purchase Certificate ST-119.1. It is designed for exempt organizations to make tax-exempt purchases in New York State. Complete this form to certify your exemption status and ensure compliance with state tax laws.

Banking

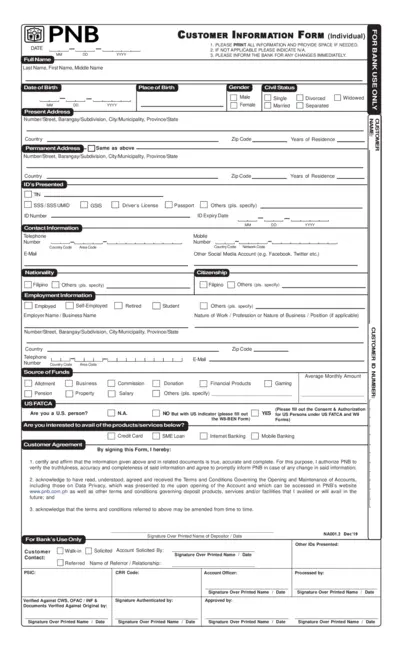

PNB Customer Information Form - Individual Details

This file is the PNB Customer Information Form designed for individuals. It collects essential personal, employment, and contact information. The form must be filled out accurately to comply with banking regulations.

Tax Forms

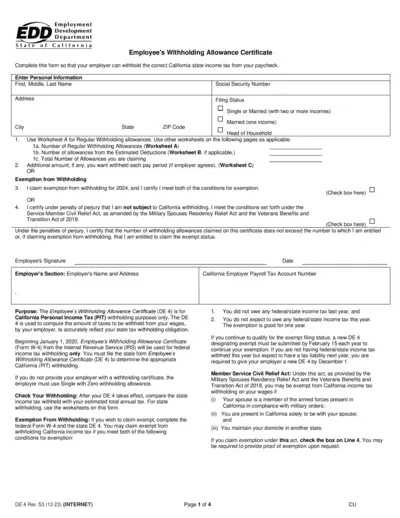

California Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate (DE 4) helps employees determine the appropriate California state income tax withholding. It's crucial for accurate payroll tax deductions based on your personal tax situation. Complete this form to ensure your employer withholds the correct amount from your paycheck.

Banking

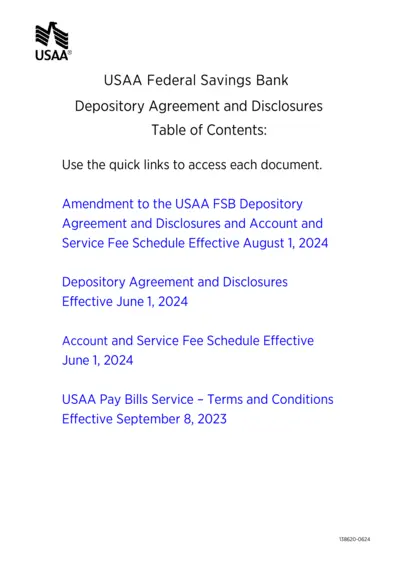

USAA Federal Savings Bank Agreement and Disclosure

This file contains the latest amendments to the USAA Federal Savings Bank Depository Agreement and Disclosures. Users can find important updates regarding account terms, fees, and penalties effective from August 1, 2024. Ensure to review these changes for a better understanding of your deposits and services.

Retirement Plans

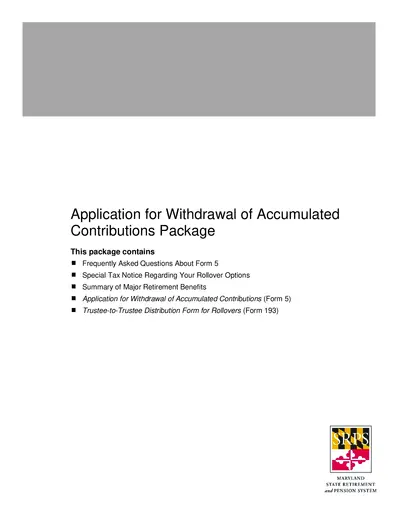

Application for Withdrawal of Accumulated Contributions

This package provides essential instructions for withdrawing your accumulated contributions from the Maryland State Retirement and Pension System. It includes FAQs, tax notices, and detailed forms to facilitate the process. The Application for Withdrawal of Accumulated Contributions (Form 5) is a critical step for those transitioning into retirement.

Tax Forms

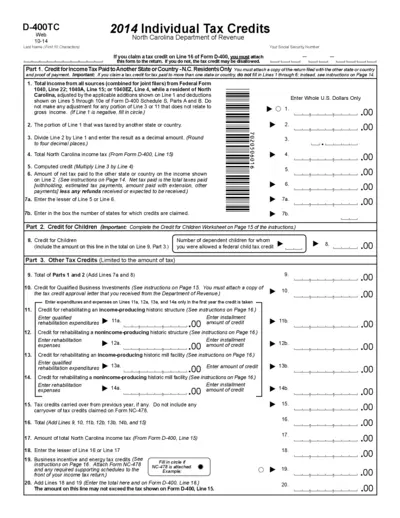

North Carolina D-400TC Tax Credit Form Instructions

The D-400TC tax credit form is essential for individuals claiming tax credits in North Carolina. This form outlines the necessary information for tax credits including those for children, business investments, and tax paid to other states. Follow the instructions carefully to ensure your credits are applied correctly.

Banking

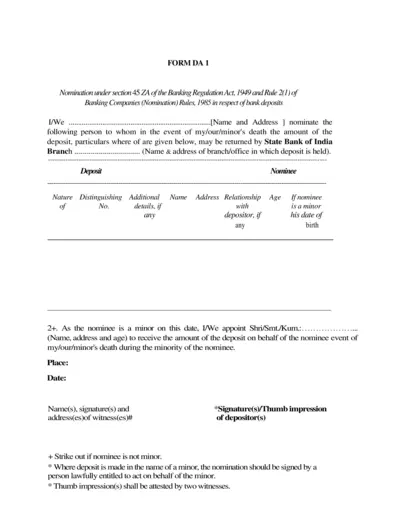

Nomination Form DA 1 for Bank Deposits

This form facilitates the nomination for bank deposits under the Banking Regulation Act. It allows depositors to name a nominee for their deposits in case of their demise. Properly filling this form ensures the smooth transfer of funds to the nominee.

Banking

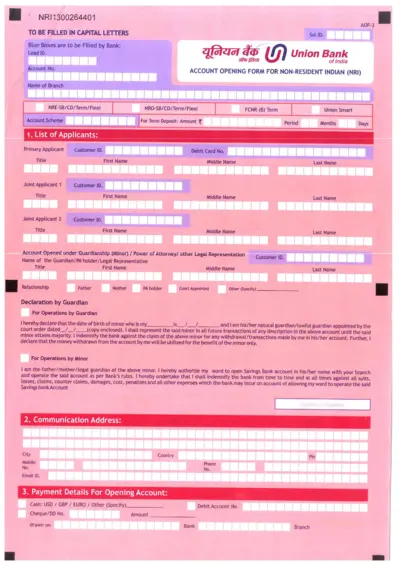

NRI Account Opening Form Instructions and Guide

This file provides crucial information for non-resident Indians to open an account at Union Bank of India. It includes detailed instructions for completing the application and all necessary requirements. Perfect for NRIs looking to manage their finances from abroad.

Tax Forms

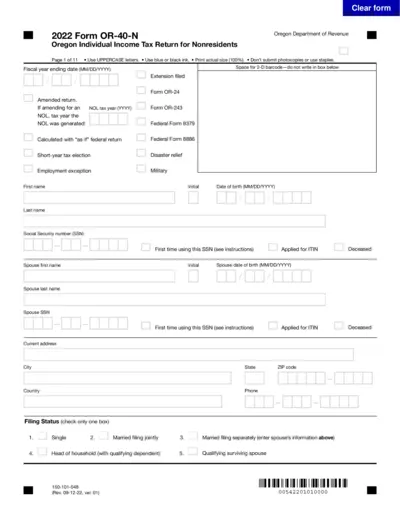

Oregon Individual Income Tax Return for Nonresidents

The 2022 Form OR-40-N is an essential document for nonresidents filing their Oregon Individual Income Tax Return. This form guides users through reporting their income, exemptions, and credits accurately. Ensure compliance with state tax laws by completing this form correctly.