Retirement Plans Documents

Retirement Plans

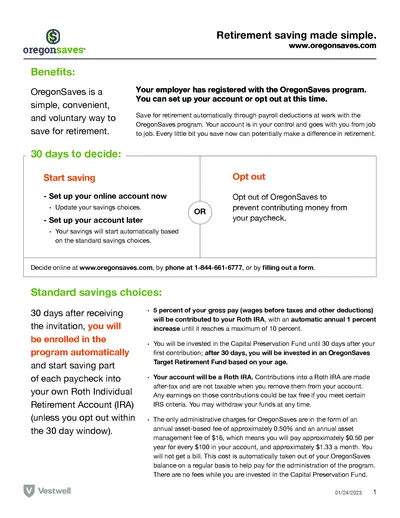

OregonSaves Retirement Savings Enrollment and Opt-Out Form

This file provides information on the OregonSaves Retirement Savings program, including benefits, enrollment instructions, and the opt-out process. Users can learn about setting up their accounts, managing contributions, and the associated fees.

Retirement Plans

401(k) Loans and Hardship Withdrawals Guide

This file offers information about 401(k) loans and hardship withdrawals to help users understand the implications and procedures involved. It provides general considerations, borrowing guidelines, and hardship withdrawal conditions. Use this guide to make informed decisions about accessing your 401(k) savings.

Retirement Plans

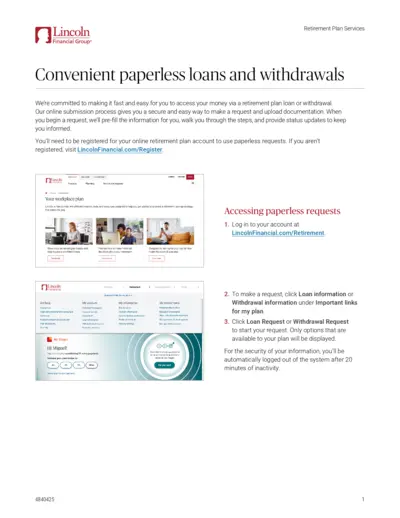

Lincoln Financial Group Retirement Plan Services Instructions

This document provides guidelines for Lincoln Financial Group's paperless loans and withdrawals. It includes steps to request a loan or withdrawal, review account information, and submit the request. Additionally, it covers tracking status, cancelling a request, and important notices.

Retirement Plans

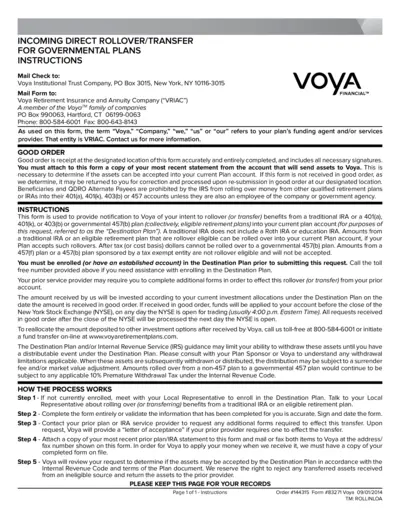

Incoming Direct Rollover Transfer Instructions

This file provides detailed instructions for rolling over or transferring benefits into your current plan account. It includes important contact information and guidance on completing necessary forms. Ideal for those looking to navigate governmental retirement plans.

Retirement Plans

Application for Withdrawal of Accumulated Contributions

This package provides essential instructions for withdrawing your accumulated contributions from the Maryland State Retirement and Pension System. It includes FAQs, tax notices, and detailed forms to facilitate the process. The Application for Withdrawal of Accumulated Contributions (Form 5) is a critical step for those transitioning into retirement.

Retirement Plans

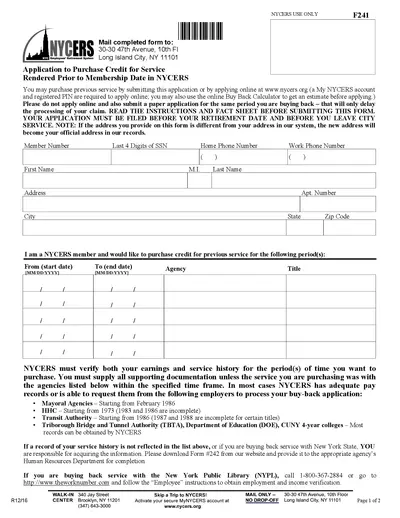

NYCERS Application for Purchase of Service Credit

This file contains the application form for NYCERS members wishing to purchase service credit for time worked before their membership. It outlines the eligibility criteria, required documentation, and submission instructions. Users can apply through a secure online portal or by mail for their convenience.

Retirement Plans

IRS Form 5305-SEP Simplified Employee Pension Agreement

Form 5305-SEP allows employers to set up Simplified Employee Pension plans for their eligible employees. These plans provide a way to contribute towards employees’ retirement savings. This form should be kept for records and not submitted to the IRS.

Retirement Plans

Vanguard Retirement Plan Beneficiary Designation

This form allows you to designate beneficiaries for your retirement plan. Proper designation ensures that your assets are distributed according to your wishes. Follow the instructions carefully to complete the form accurately.

Retirement Plans

CalPERS Service Retirement Election Application

This document is the CalPERS Service Retirement Election Application form. It provides essential instructions and details required for retirement benefits. Complete this form to ensure accurate processing of your retirement benefits.

Retirement Plans

Massachusetts State Retirement Board Superannuation Application

This file provides comprehensive information regarding the superannuation retirement application process in Massachusetts. It includes detailed instructions on filing your application, eligibility requirements, and necessary documentation. Use this guide to navigate the retirement application process smoothly.

Retirement Plans

Cal Savers Employee Opt Out Form Instructions

The Cal Savers Employee Opt-Out Form allows employees to voluntarily opt out of payroll contributions to their retirement savings. This form ensures that your savings are in your control and allows you to manage your retirement funds effectively. If you decide to opt out, you can do so at any time and return to participating later.

Retirement Plans

Transamerica Retirement Solutions Opt Out Refund Form

This form is for participants who wish to opt out of automatic enrollment in the retirement plan. Participants must complete this form within 90 days of their first automatic deferral. Ensure that all information is accurate for successful processing.